Question: Problem 3-2 problem 3-8 lers Billed in (3) Cash is deposited in the bank night depositony 6. Employees are paid weekly paychecks Vendors noted in

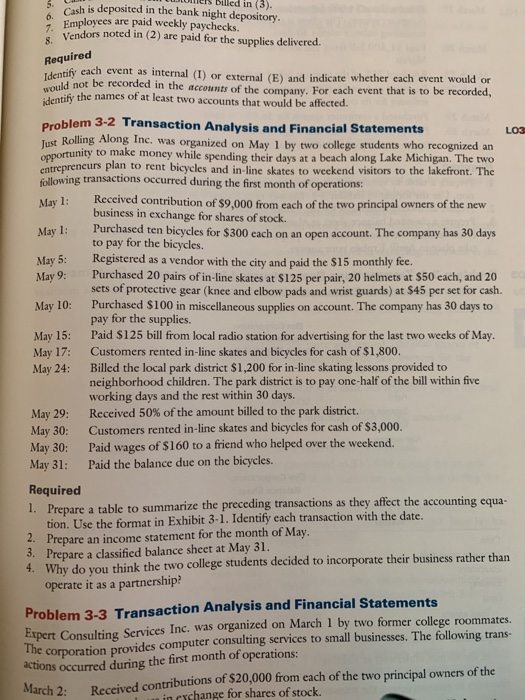

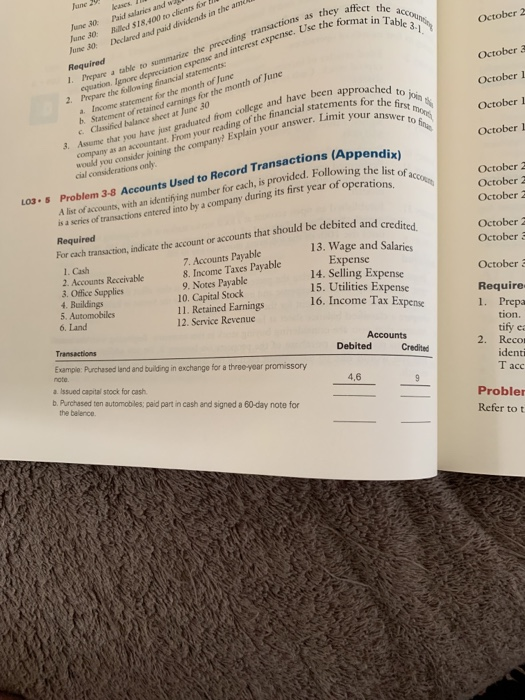

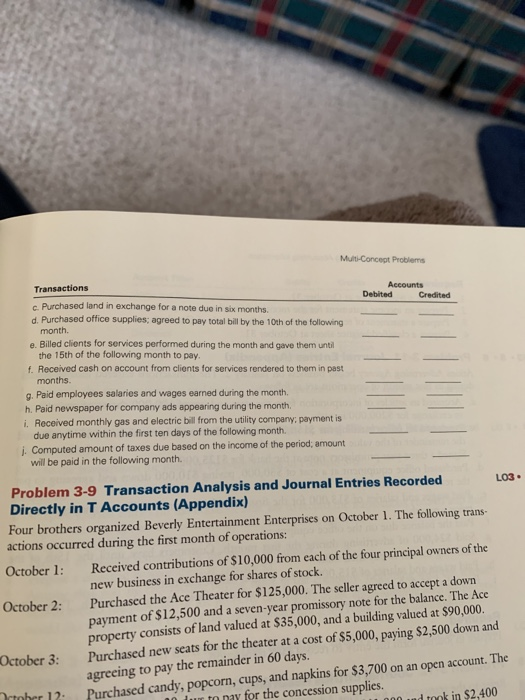

lers Billed in (3) Cash is deposited in the bank night depositony 6. Employees are paid weekly paychecks Vendors noted in (2) are paid for the supplies delivered 8. Required Idend not be recorded in the accounts of the company. For each event identify the names of at least two accounts that would be affected. each event as internal (I) or external (E) and indicate whether each event would or i ccounts of the company. For each event that is to be recorded, Problem 3-2 Transaction Analysis and Financial Statements LO3 st Roll ing Along Inc. was organized on May 1 by two college students who recognized an Ju ortunity to make money while spending their days at a beach along Lake Michigan. The two repreneurs plan to rent bicycles and in-line skates to weekend visitors to the lakefront. The following transactions occurred during the first month of operations: Received contribution of $9,000 from each of the two principal owners of the new business in exchange for shares of stock. Purchased ten bicycles for $300 each on an open account. The company has 30 days to pay for the bicycles Registered as a vendor with the city and paid the $15 monthly fee Purchased 20 pairs of in-line skates at $125 per pair, 20 helmets at $50 each, and 20 sets of protective gear (knee and elbow pads and wrist guards) at $45 per set for cash. Purchased $100 in miscellaneous supplies on account. The company has 30 days to pay for the supplies Paid $125 bill from local radio station for advertising for the last two weeks of May Customers rented in-line skates and bicycles for cash of $1,800 Billed the local park district $1,200 for in-line skating lessons provided to neighborhood children. The park district is to pay one-half of the bill within five working days and the rest within 30 days ay 1: May 1: May 5: May 9: May 10: May 15: May 17: May 24: May 29: Received 50% of the amount billed to the park district. May 30: Customers rented in-line skates and bicycles for cash of $3,000 May 30: Paid wages of $160 to a friend who helped over the weekend. May 31: Paid the balance due on the bicycles Required a table to summarize the preceding transactions as they affect the accounting equa tion. Use the format in Exhibit 3-1. Identify each transaction with the date Prepare an income statement for the month of May Prepare a classified balance sheet at May 31 Why do you think the two college students decided to incorporate their business rather than operate it as a partnership? 2. Problem 3-3 Transaction Analysis and Financial Statements Expert Consulting Services Inc. was organized on March 1 by two former college roommates. The corporation provides computer consulting services to small businesses. The following trans- actions occurred during the first month of operations: March 2: Received contributions of $20,000 from each of the two principal owners of the in eychange for shares of stock. uneleases une 30 Paid salarics and w June 30 Billed $18,400 to clients for t une 80Declared and paid dividends in the ami equired affect the accou nat in Tah eyuation. Ignore depreciation expense and interest expense. Use the forte Prepare the folloning financial statements October 2 I. Prepare a table to summurive the preceding transactions as they Octobera October l October I October ncome statement for the month of June h. Statement cClassified balance sheet at June 30 From your reading of the financial statements r to oy Eyplain your answer. Limit youh i of retained carnings for the month of June first mont 3. Assume that you have just you have just gradusted from collge and have been company as an woukd you consider joining the cial considerations onk the list of acco Los.5 Problem 3-8 Accounts Used to Record Transactions (A LO3. 5 Probl October 2 A list of acc list of accouns, with an identifying number for cach, is provided. Followi of transctions entered into by a company during its first year ofo is a series of Required For cach transaction, indicate the October 2 account or accounts that should be debited and credited 13. Wage and Salaries October 2 October 3 7. Accounts Payable 8. Income Taxes Payable 9. Notes Payabe l. Cash 2. Accounts Receivable 3. Office Supplies 4. Buildings 5. Automobiles Expense 14. Selling Expense 15. Utilities Expense 16. Income Tax Expense October 10. Capital Stock 11. Retained Earnings 12. Service Revenue Require 6. Land 1. Prepa tion tify e Accounts Debited Example: Purchased land and building in exchange for a three year promissory a. Issued capital stock for cash b. Purchased ten automobiles: paid part in cash and signed a 60-day note for Credited 2. Recor identi T acc 4,6 the balence Probler Refer to t Multi-Concept Problems Transactions c. Purchased land in exchange for a note due in six months d. Purchased office supplies; agreed to pay total bill by the 10th of the following Debited Credited month. e. Billed clients for services performed during the month and gave them until the 15th of the following month to pay. f. Received cash on account from clients for services rendered to them in past months g. Paid employees salaries and wages earned during the month. h. Paid newspaper for company ads appearing during the month i. Received monthly gas and electric bill from the utility company; payment is due anytime within the first ten days of the following month. i. Computed amount of taxes due based on the income of the period, amount will be paid in the following month Problem 3-9 Transaction Analysis and Journal Entries Recorded Directly in T Accounts (Appendix) Four brothers organized Beverly Entertainment Enterprises on October 1. The following trans- actions occurred during the first month of operations: LO3 Received contributions of $10,000 from each of the four principal owners of the new business in exchange for shares of stock. Purchased the Ace Theater for $125,000. The seller agreed to accept a down payment of S$12,500 and a seven-year promissory note for the balance. The Acc property consists of land valued at $35,000, and a building valued at $90,000. October 1: October 2: October 3: Purchased new seats for the theater at a cost of $5,00, paying $2,500 down and Purchased candy, popcorn, ups, and napkins for $3,700 on an open account. The ur tn nay for the concession supplies. agreeing to pay the remainder in 60 days. hrr 1 0 ud took in $2,400

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts