Question: Problem 3-21 Calculating EFN The most recent financial statements for Scott, Inc., appear below. Sales for 2020 are projected to grow by 20 percent Interest

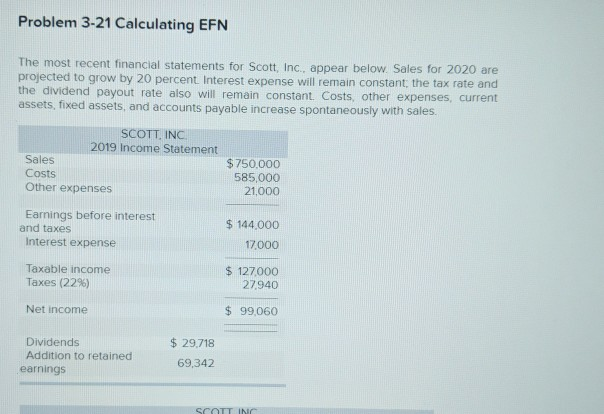

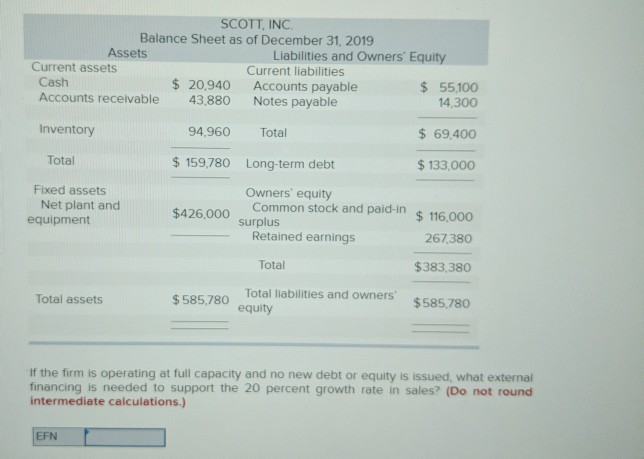

Problem 3-21 Calculating EFN The most recent financial statements for Scott, Inc., appear below. Sales for 2020 are projected to grow by 20 percent Interest expense will remain constant, the tax rate and the dividend payout rate also will remain constant Costs, other expenses, current assets, fixed assets, and accounts payable increase spontaneously with sales. SCOTT, INC 2019 Income Statement Sales $ 750.000 Costs 585,000 Other expenses 21.000 Earnings before interest and taxes Interest expense $ 144 000 17.000 Taxable income Taxes (229) $ 127000 27940 Net income $ 99,060 Dividends Addition to retained earnings $ 29.718 69,342 SCOTT INC SCOTT, INC. Balance Sheet as of December 31, 2019 Assets Liabilities and Owners' Equity Current assets Current liabilities Cash $ 20,940 Accounts payable $ 55,100 Accounts receivable 43,880 Notes payable 14,300 Inventory 94,960 Total $ 69.400 Total $ 159,780 Long-term debt $ 133,000 Fixed assets Net plant and equipment $426,000 Owners' equity Common stock and paid-in $116.000 surplus Retained earnings 267,380 Total $383,380 Total assets $585,780 Total liabilities and owners equity $585780 'If the firm is operating at full capacity and no new debt or equity is issued, what external financing is needed to support the 20 percent growth rate in sales? (Do not round intermediate calculations.) EFN

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts