Question: Problem 3-3 Revenue recognition over time and at a point in time under ASC Topic 606 (LO3-4) MSK Construction Company contracted to construct a factory

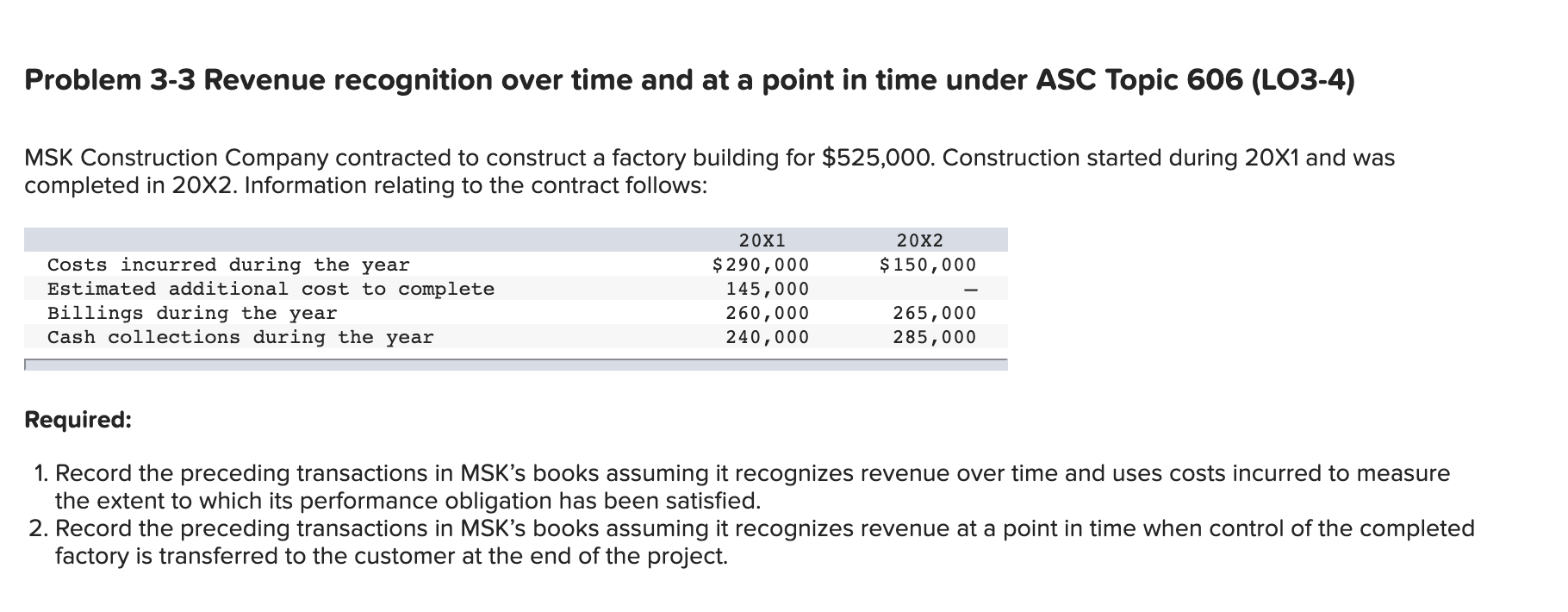

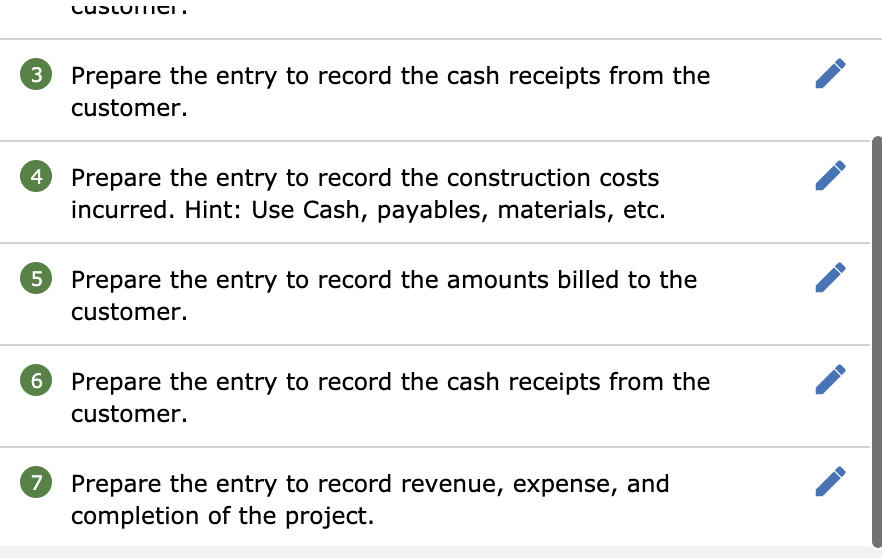

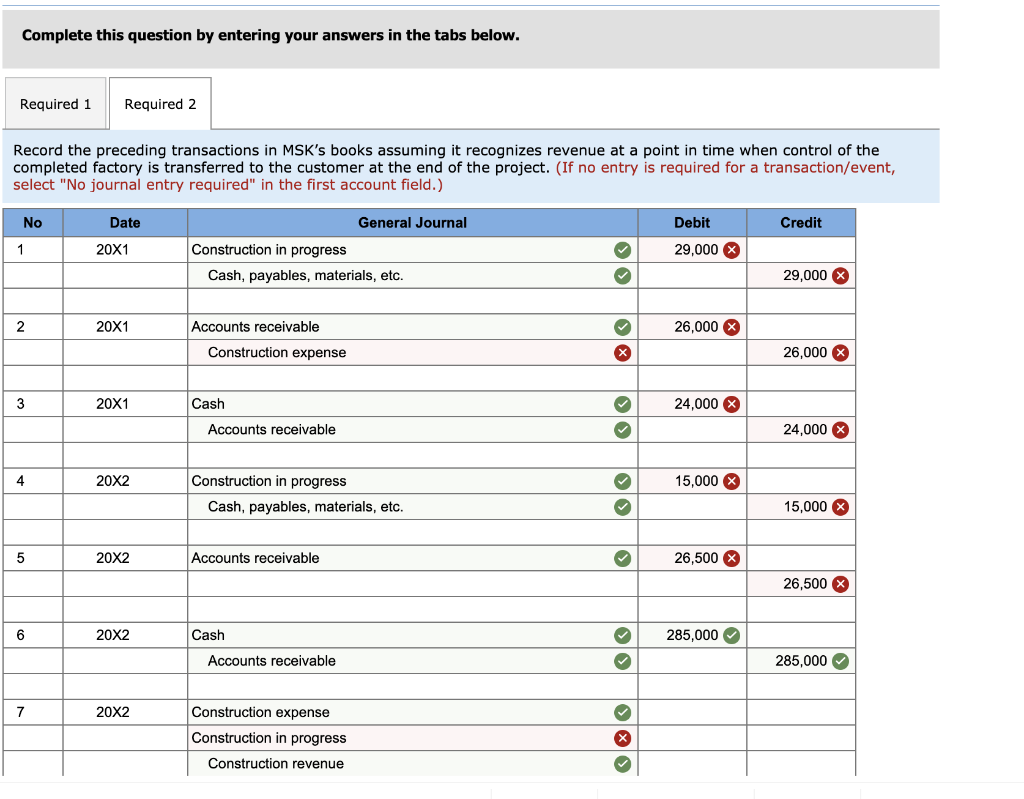

Problem 3-3 Revenue recognition over time and at a point in time under ASC Topic 606 (LO3-4) MSK Construction Company contracted to construct a factory building for $525,000. Construction started during 20X1 and was completed in 20X2. Information relating to the contract follows: 20x2 $ 150,000 Costs incurred during the year Estimated additional cost to complete Billings during the year Cash collections during the year 20x1 $ 290,000 145,000 260,000 240,000 265,000 285,000 Required: 1. Record the preceding transactions in MSK's books assuming it recognizes revenue over time and uses costs incurred to measure the extent to which its performance obligation has been satisfied. 2. Record the preceding transactions in MSK's books assuming it recognizes revenue at a point in time when control of the completed factory is transferred to the customer at the end of the project. cuSLUITICI. 3 Prepare the entry to record the cash receipts from the customer. 4 Prepare the entry to record the construction costs incurred. Hint: Use Cash, payables, materials, etc. 5 Prepare the entry to record the amounts billed to the customer. 6 Prepare the entry to record the cash receipts from the customer. 7 Prepare the entry to record revenue, expense, and completion of the project. Complete this question by entering your answers in the tabs below. Required 1 Required 2 Record the preceding transactions in MSK's books assuming it recognizes revenue at a point in time when control of the completed factory is transferred to the customer at the end of the project. (If no entry is required for a transaction/event, select "No journal entry required" in the first account field.) No Date General Journal Debit Credit 1 20X1 29,000 X Construction in progress Cash, payables, materials, etc. 29,000 X 2 20X1 26,000 X Accounts receivable Construction expense X 26,000 X 3 20X1 Cash 24,000 X Accounts receivable 24,000 X 4 20X2 15,000 X Construction in progress Cash, payables, materials, etc. 15,000 X 5 20X2 Accounts receivable 26,500 X 26,500 X 6 20X2 Cash 285,000 Accounts receivable 285,000 7 20X2 Construction expense Construction in progress Construction revenue x

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts