Question: Problem 3-30A Recording adjusting entries in general journal format LO 3-2 Each of the following independent events requires a year-end adjusting entry. a. Paid $48,000

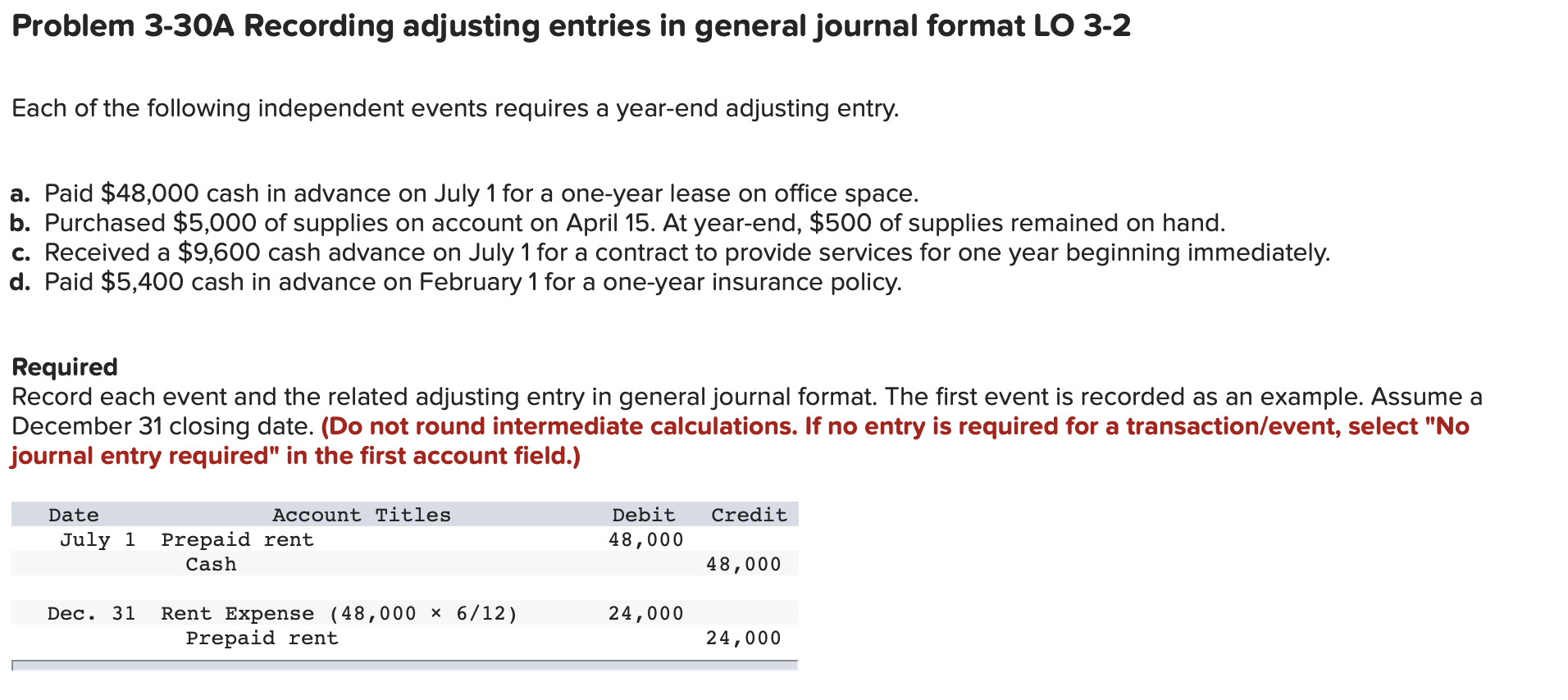

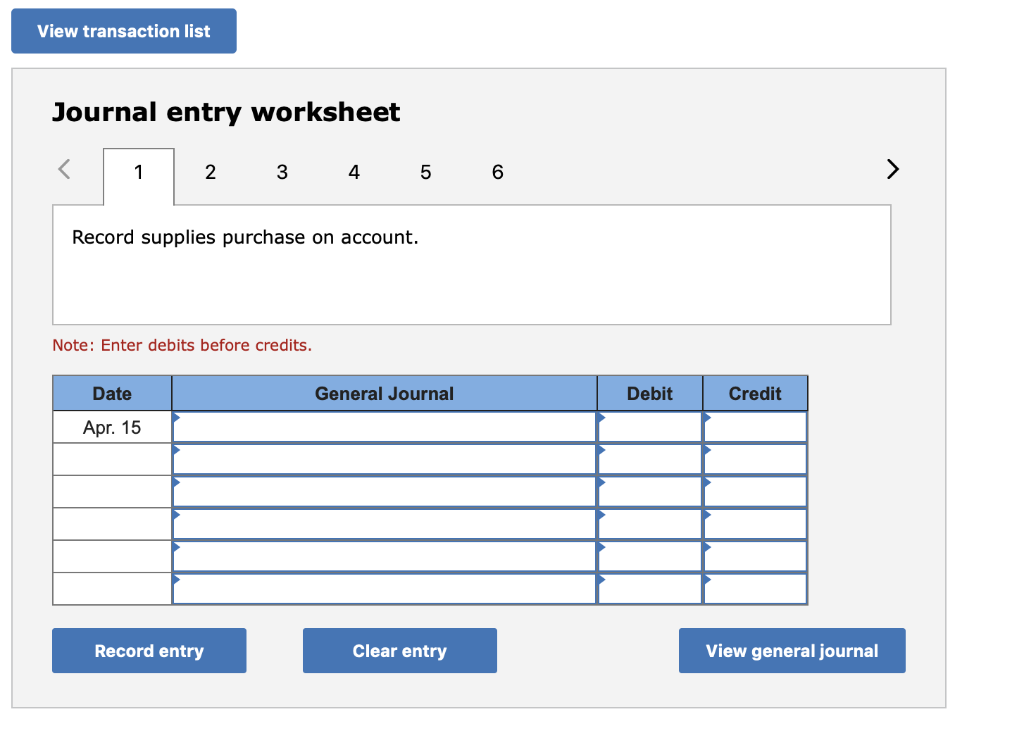

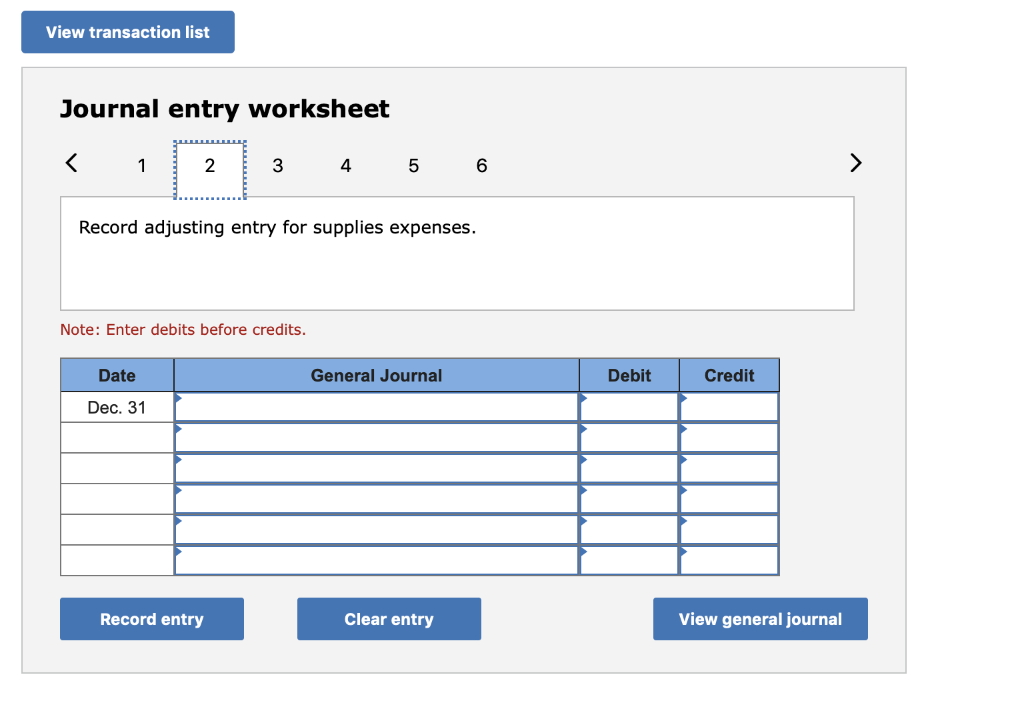

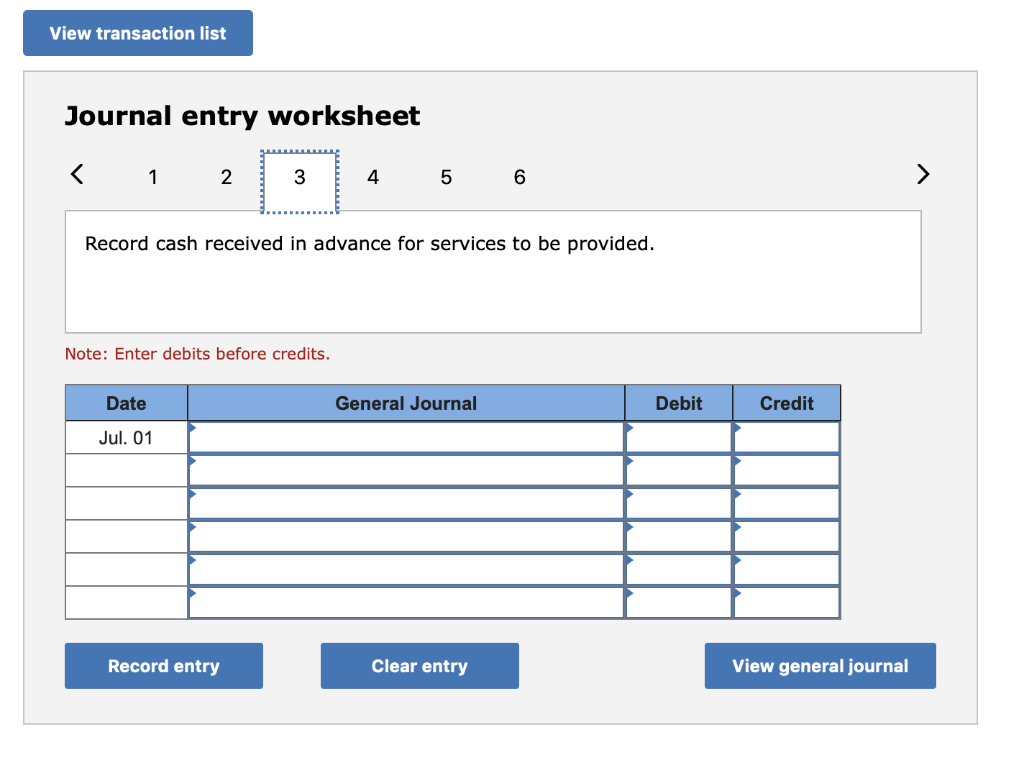

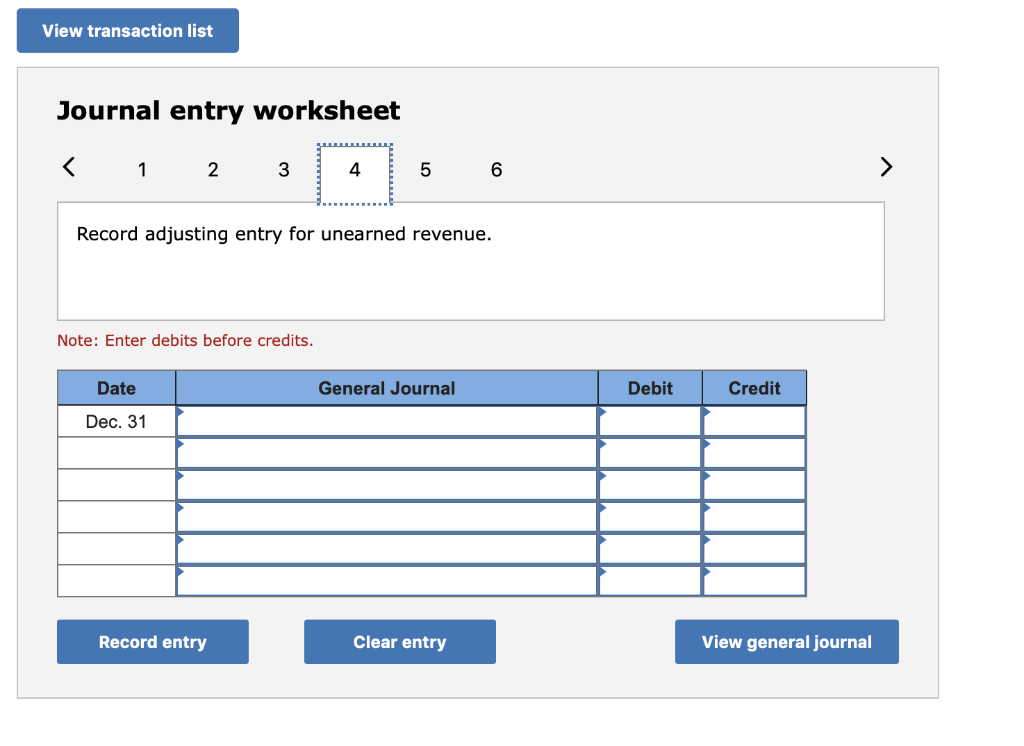

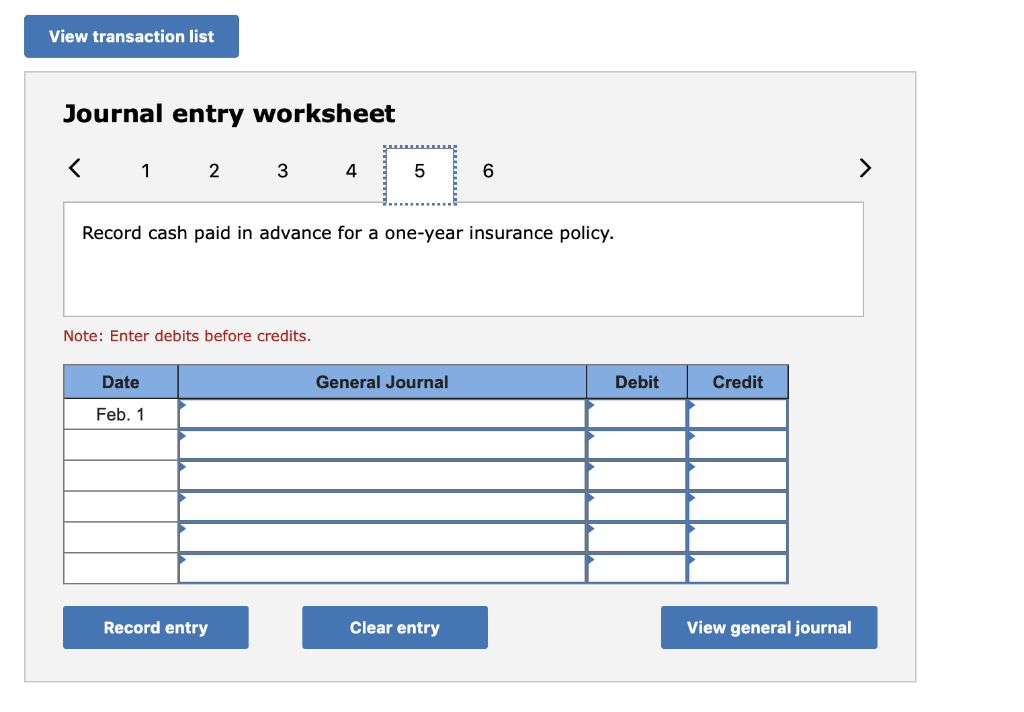

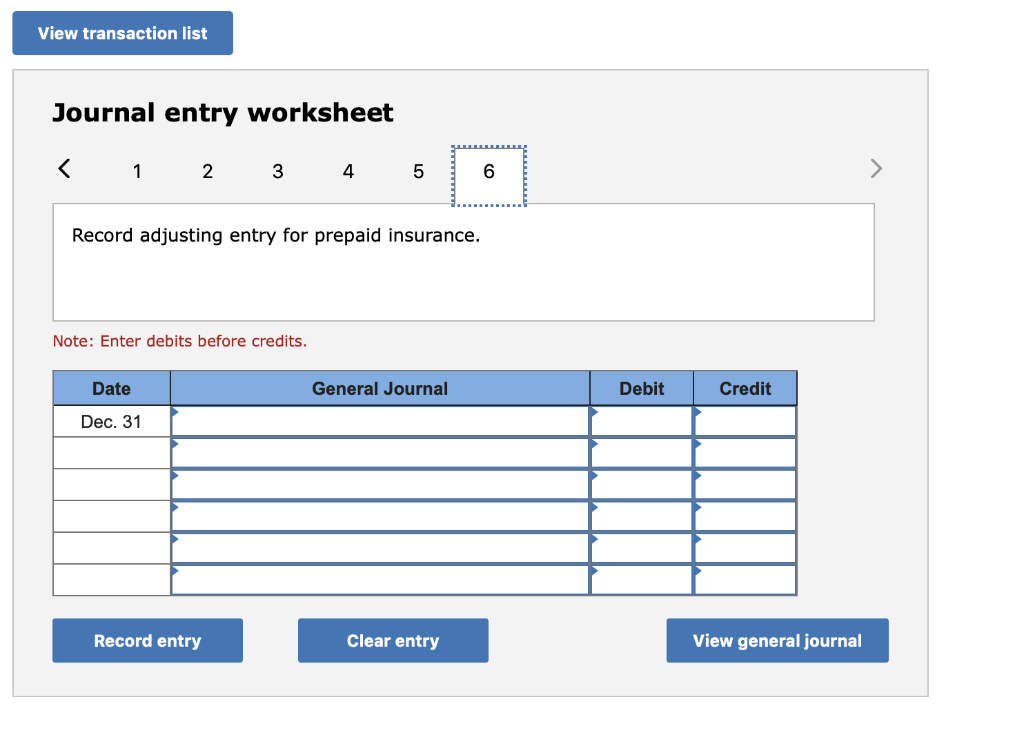

Problem 3-30A Recording adjusting entries in general journal format LO 3-2 Each of the following independent events requires a year-end adjusting entry. a. Paid $48,000 cash in advance on July 1 for a one-year lease on office space. b. Purchased $5,000 of supplies on account on April 15. At year-end, $500 of supplies remained on hand. C. Received a $9,600 cash advance on July 1 for a contract to provide services for one year beginning immediately d. Paid $5,400 cash in advance on February 1 for a one-year insurance policy. Required Record each event and the related adjusting entry in general journal format. The first event is recorded as an example. Assume a December 31 closing date. (Do not round intermediate calculations. If no entry is required for a transaction/event, select "No journal entry required" in the first account field.) Credit Date Account Titles July 1 Prepaid rent Cash Debit 48,000 48,000 24,000 Dec. 31 Rent Expense (48,000 x 6/12) Prepaid rent 24,000 View transaction list Journal entry worksheet 2 3 4 5 6 Record supplies purchase on account. Note: Enter debits before credits. Date General Journal Debit Credit Apr. 15 Record entry Clear entry View general journal View transaction list Journal entry worksheet

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts