Question: Problem 3-37 (LO 3-3) Nancy, who is 59 years old, is the beneficiary of a $200,000 life insurance policy. What amount of the insurance proceeds

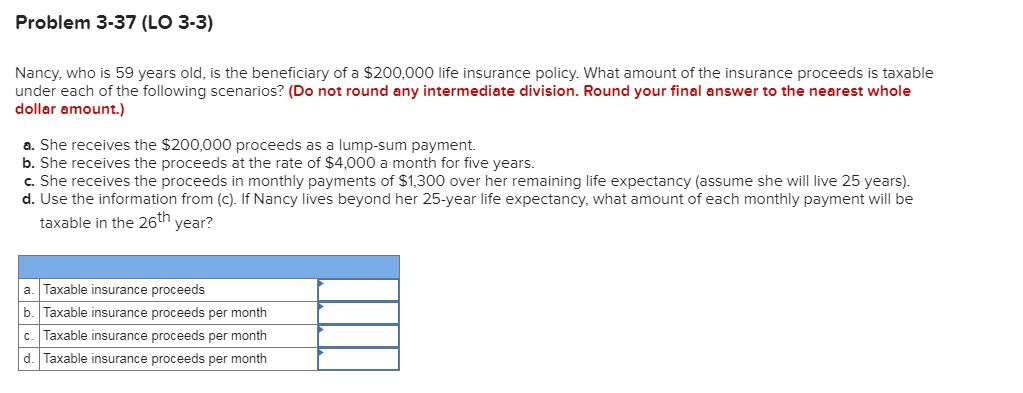

Problem 3-37 (LO 3-3) Nancy, who is 59 years old, is the beneficiary of a $200,000 life insurance policy. What amount of the insurance proceeds is taxable under each of the following scenarios? (Do not round any intermediate division. Round your final answer to the nearest whole dollar amount.) a. She receives the $200,000 proceeds as a lump-sum payment. b. She receives the proceeds at the rate of $4,000 a month for five years. c. She receives the proceeds in monthly payments of $1,300 over her remaining life expectancy (assume she will live 25 years). d. Use the information from (c). If Nancy lives beyond her 25-year life expectancy, what amount of each monthly payment will be taxable in the 26th year? a. Taxable insurance proceeds b. Taxable insurance proceeds per month c. Taxable insurance proceeds per month d. Taxable insurance proceeds per month

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts