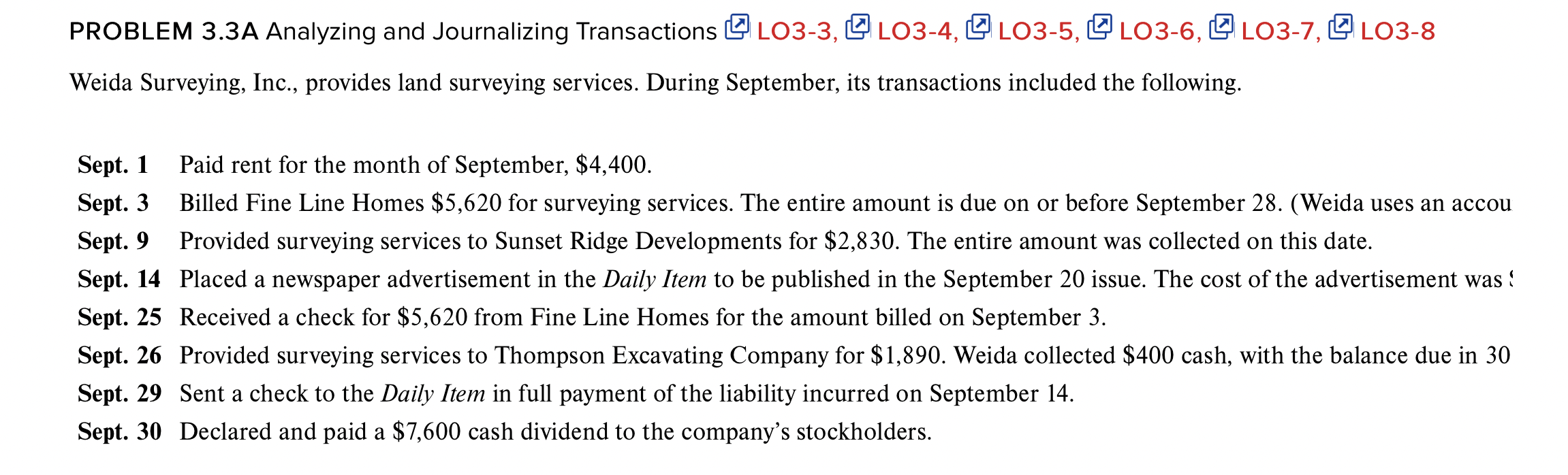

Question: PROBLEM 3.3A Analyzing and Journalizing Transactions O L03-3, Q 403-4, 103-5, QL03-6, Q 103-7, O L03-8 Weida Surveying, Inc., provides land surveying services. During September,

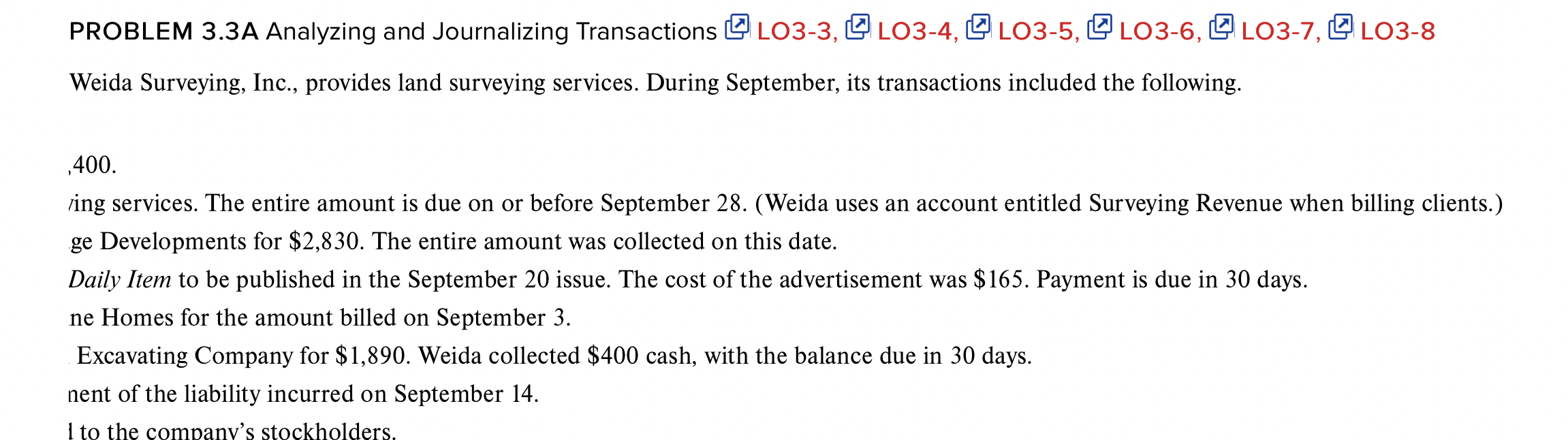

PROBLEM 3.3A Analyzing and Journalizing Transactions O L03-3, Q 403-4, 103-5, QL03-6, Q 103-7, O L03-8 Weida Surveying, Inc., provides land surveying services. During September, its transactions included the following. Sept. 1 Paid rent for the month of September, $4,400. Sept. 3 Billed Fine Line Homes $5,620 for surveying services. The entire amount is due on or before September 28. (Weida uses an accou Sept. 9 Provided surveying services to Sunset Ridge Developments for $2,830. The entire amount was collected on this date. Sept. 14 Placed a newspaper advertisement in the Daily Item to be published in the September 20 issue. The cost of the advertisement was : Sept. 25 Received a check for $5,620 from Fine Line Homes for the amount billed on September 3. Sept. 26 Provided surveying services to Thompson Excavating Company for $1,890. Weida collected $400 cash, with the balance due in 30 Sept. 29 Sent a check to the Daily Item in full payment of the liability incurred on September 14. Sept. 30 Declared and paid a $7,600 cash dividend to the company's stockholders. PROBLEM 3.3A Analyzing and Journalizing Transactions O L03-3, Q 403-4, 103-5, QL03-6, Q 103-7, O L03-8 Weida Surveying, Inc., provides land surveying services. During September, its transactions included the following. ,400. ring services. The entire amount is due on or before September 28. (Weida uses an account entitled Surveying Revenue when billing clients.) ge Developments for $2,830. The entire amount was collected on this date. Daily Item to be published in the September 20 issue. The cost of the advertisement was $165. Payment is due in 30 days. ne Homes for the amount billed on September 3. Excavating Company for $1,890. Weida collected $400 cash, with the balance due in 30 days. nent of the liability incurred on September 14. 1 to the company's stockholders. Instructions a. Prepare an analysis of each of these transactions. Transaction 1 serves as an example of the form of analysis to be used. 1. (a) The asset Accounts Receivable was increased. Increases in assets are recorded by debits. Debit Accounts Receivable $2,500. (b) Revenue has been earned. Revenue increases owners' equity. Increases in owners' equity are recorded by credits. Credit Testing Service Revenue $2,500. b. Prepare journal entries, including explanations, for these transactions. c. How does the realization principle influence the manner in which the August 1 billing to customers is recorded in the accounting records? d. How does the matching principle influence the manner in which the August 3 purchase of testing supplies is recorded in the accounting records

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts