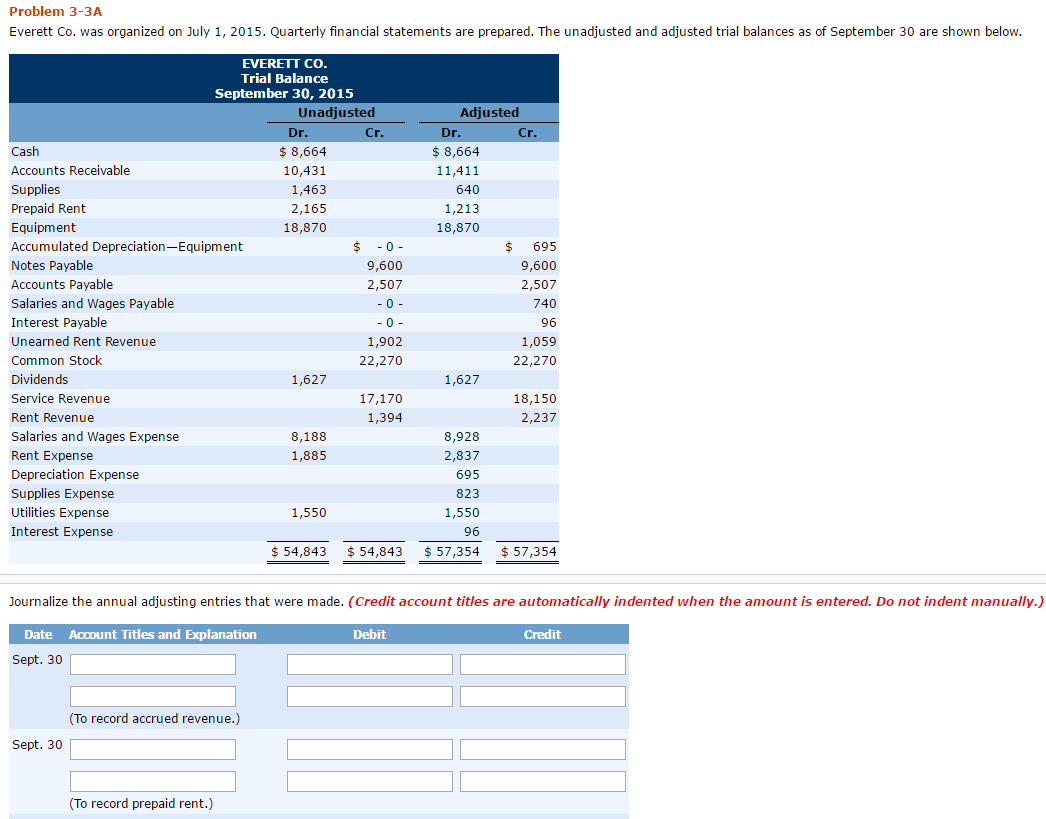

Question: Problem 3-3A Everett Co. was organized on July 1, 2015. Quarterly financial statements are prepared. The unadjusted and adjusted trial balances as of September 30

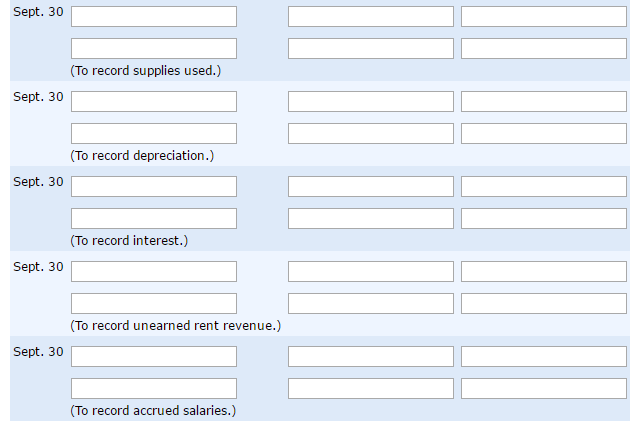

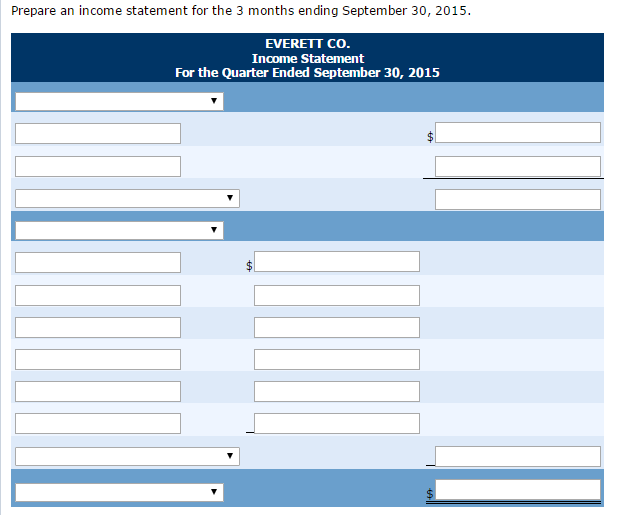

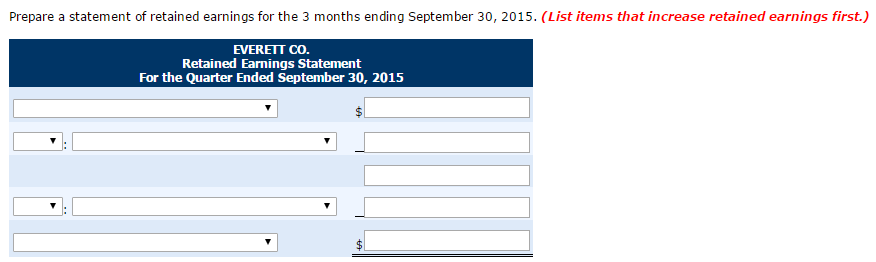

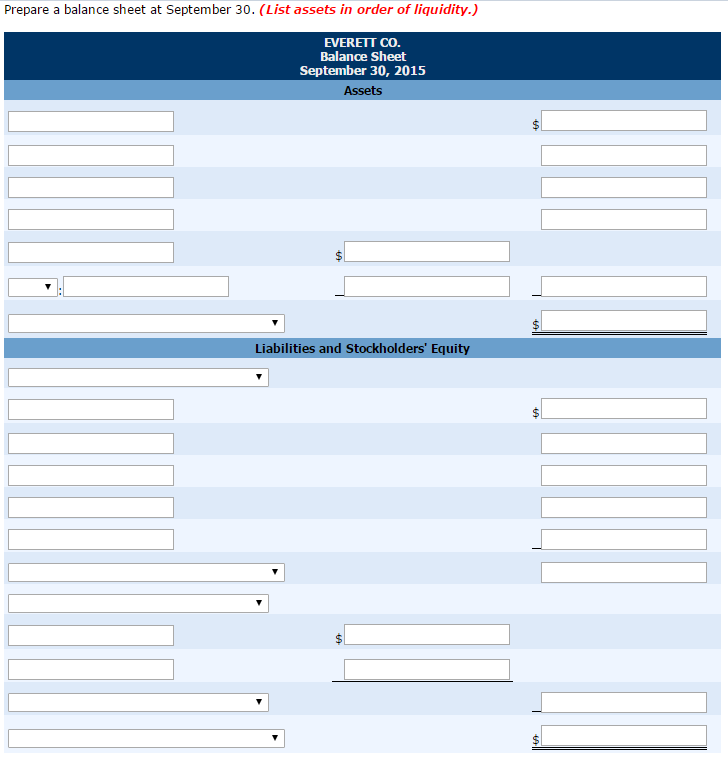

Problem 3-3A Everett Co. was organized on July 1, 2015. Quarterly financial statements are prepared. The unadjusted and adjusted trial balances as of September 30 are shown below. EVERETT CO. Trial Balance September 30, 2015 Unadjusted Adjusted Dr Cr Dr Cr Cash 8,664 8,664 Accounts Receivable 10,431 11,411 Supplies 1,463 640 Prepaid Rent 1,213 2,165 Equipment 18,870 18,870 Accumulated Depreciation-Equipment 695 Notes Payable 9,600 9,600 Accounts payable 2,507 2,507 -0- 740 Salaries and Wages Payable Interest Payable 96 1,902 1,059 Unearned Rent Revenue Common Stock 22,270 22,270 Dividends 1,627 1,627 17,170 Service Revenue 18,150 1,394 2,237 Rent Revenue Salaries and Wages Expense 8,188 8,928 Rent Expense 1,885 2,837 Depreciation Expense 695 Supplies Expense 823 Utilities Expense 1,550 1,550 Interest Expense 96 54,843 54,843 57,354 57,354 Journalize the annual adjusting entries that were made. (Credit account titles are automatically indented when the amount is entered. Do not indent manually.) Date Account Titles and Explanation Debit Credit Sept. 30 (To record accrued revenue.) Sept. 30 (To record prepaid rent.) Problem 3-3A Everett Co. was organized on July 1, 2015. Quarterly financial statements are prepared. The unadjusted and adjusted trial balances as of September 30 are shown below. EVERETT CO. Trial Balance September 30, 2015 Unadjusted Adjusted Dr Cr Dr Cr Cash 8,664 8,664 Accounts Receivable 10,431 11,411 Supplies 1,463 640 Prepaid Rent 1,213 2,165 Equipment 18,870 18,870 Accumulated Depreciation-Equipment 695 Notes Payable 9,600 9,600 Accounts payable 2,507 2,507 -0- 740 Salaries and Wages Payable Interest Payable 96 1,902 1,059 Unearned Rent Revenue Common Stock 22,270 22,270 Dividends 1,627 1,627 17,170 Service Revenue 18,150 1,394 2,237 Rent Revenue Salaries and Wages Expense 8,188 8,928 Rent Expense 1,885 2,837 Depreciation Expense 695 Supplies Expense 823 Utilities Expense 1,550 1,550 Interest Expense 96 54,843 54,843 57,354 57,354 Journalize the annual adjusting entries that were made. (Credit account titles are automatically indented when the amount is entered. Do not indent manually.) Date Account Titles and Explanation Debit Credit Sept. 30 (To record accrued revenue.) Sept. 30 (To record prepaid rent.)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts