Question: Problem 3-3B Record adjusting entries (LO3-3) The information necessary for preparing the 2021 year-end adjusting entries for Bearcat Personal Training Academy appears below. Bearcat's fiscal

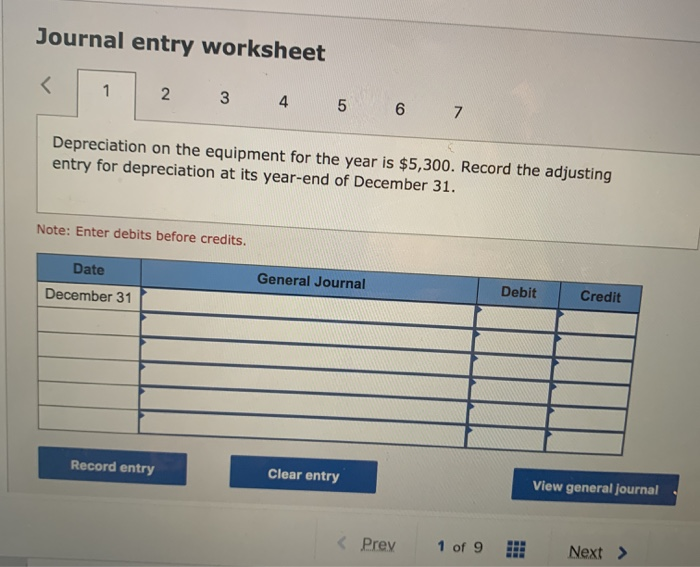

Problem 3-3B Record adjusting entries (LO3-3) The information necessary for preparing the 2021 year-end adjusting entries for Bearcat Personal Training Academy appears below. Bearcat's fiscal year-end is December 31. 1. Depreciation on the equipment for the year is $5,300. 2. Salaries earned (but not paid) from December 16 through December 31, 2021, are $2,300. 3. On March 1, 2021, Bearcat lends an employee $11,500. The employee signs a note requiring principal and interest at 12% to be paid on February 28, 2022. 4. On April 1.2021, Bearcat pays an insurance company $11,160 for a two-year fire insurance policy. The entire $11,160 is debited to Prepaid Insurance at the time of the purchase. 5. Bearcat uses $850 of supplies in 2021 6. A customer pays Bearcat $2,190 on October 31, 2021. for three months of personal training to begin November 1, 2021. Bearca credits Deferred Revenue at the time of cash receipt. 7. On December 1, 2021, Bearcat pays $3,450 rent to the owner of the building. The payment represents rent for December 2021 through February 2022, at $1,150 per month. Prepaid Rent is debited at the time of the payment. Required: Record the necessary adjusting entries at December 31, 2021. No prior adjustments have been made during 2021. (Do not round Intermediate calculations. If no entry is required for a particular transaction/event, select "No Journal Entry Required in the first account field.) View transaction list 1 Depreciation on the equipment for the year is $5,300. Record the adjusting entry for depreciation at its year- end of December 31. 2 Salaries earned (but not paid) from December 16 through December 31, 2021, are $2,300. Record the adjusting entry for salaries at its year-end of December 31. 3 On March 1, 2021, Bearcat lends an employee $11,500. The employee signs a note requiring principal and interest at 12% to be paid on February 28, 2022. Record the adjusting entry for interest at its year-end of December 31. 4 On April 1, 2021, Bearcat pays an insurance company $11,160 for a two-year fire insurance policy. The entire $11,160 is debited to Prepaid Insurance at the time of the purchase. Record the adjusting entry for insurance at its year-end of December 31. Jst 5 Bearcat uses $850 of supplies in 2021. Record the adjusting entry for supplies at its year-end of December 31. 6 A customer pays Bearcat $2,190 on October 31, 2021, for three months of personal training to begin November 1, 2021. Bearcat credits Deferred Revenue at the time of cash receipt. Record the adjusting entry for deferred revenue at its year-end of December 31. View transaction list 5 Bearcat uses $850 of supplies in 2021. Record the adjusting entry for supplies at its year-end of December 31. 6 A customer pays Bearcat $2,190 on October 31, 2021, for three months of personal training to begin November 1, 2021. Bearcat credits Deferred Revenue at the time of cash receipt. Record the adjusting entry for deferred revenue at its year-end of December 2 On December 1, 2021, Bearcat pays $3,450 rent to the owner of the building. The payment represents rent for December 2021 through February 2022, at $1,150 per month. Prepaid Rent is debited at the time of the payment. Record the adjusting entry for rent at its year- end of December 31. Journal entry worksheet 2 3 4 5 6 7 Depreciation on the equipment for the year is $5,300. Record the adjusting entry for depreciation at its year-end of December 31. Note: Enter debits before credits. Date General Journal Debit Credit December 31 Record entry Clear entry View general journal Prey 1 of 9 Next >

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts