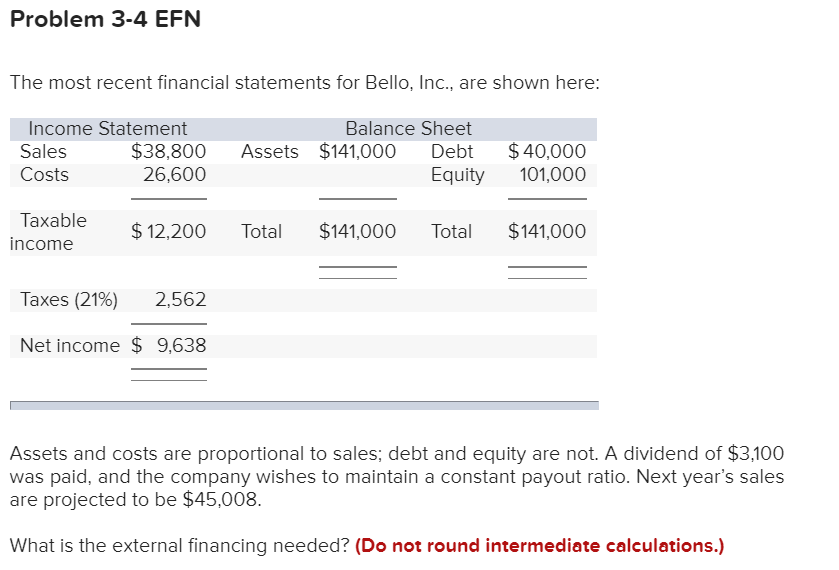

Question: Problem 3-4 EFN The most recent financial statements for Bello, Inc., are shown here: Income Statement Sales $38,800 Costs 26,600 Balance Sheet Assets $141,000 Debt

Problem 3-4 EFN The most recent financial statements for Bello, Inc., are shown here: Income Statement Sales $38,800 Costs 26,600 Balance Sheet Assets $141,000 Debt Equity $40,000 101,000 Taxable income $ 12,200 Total $141,000 Total $141,000 Taxes (21%) 2,562 Net income $ 9,638 Assets and costs are proportional to sales; debt and equity are not. A dividend of $3,100 was paid, and the company wishes to maintain a constant payout ratio. Next year's sales are projected to be $45,008. What is the external financing needed? (Do not round intermediate calculations.)

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock