Question: Problem 34. Without obtaining an extension, Ruby files her income tax return 100 days after the due date. With her return, she pays an additional

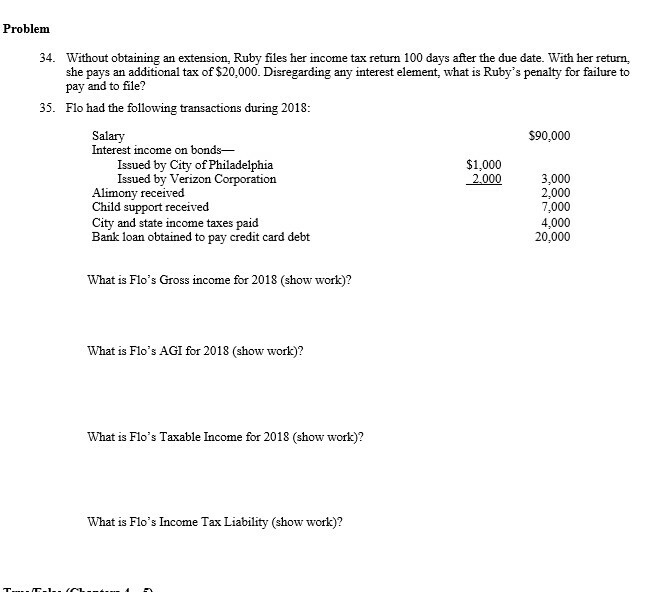

Problem 34. Without obtaining an extension, Ruby files her income tax return 100 days after the due date. With her return, she pays an additional tax of $20,000. Disregarding any interest element, what is Ruby's penalty for failure to pay and to file? 35. Flo had the following transactions during 2018 90,000 Salary Interest inc ome on bonds- Issued by City of Philadelphia Issued by Verizon Corporation $1,000 2000 3 Alimony received Child support received City and state income taxes paid Bank loan obtained to pay credit card debt 3,000 2,000 7,000 4,000 20,000 What is Flo's Gross income for 2018 (show work)? What is Flo's AGI for 2018 (show work)? What is Flo's Taxable Income for 2018 (show work)? What is Flo's Income Tax Liability (show work)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts