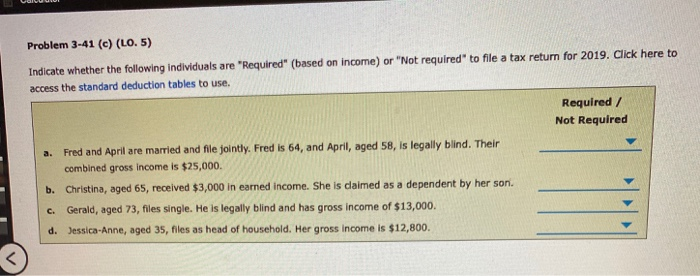

Question: Problem 3-41 (c) (LO. 5) Indicate whether the following individuals are Required (based on income) or Not required to file a tax return for 2019.

Problem 3-41 (c) (LO. 5) Indicate whether the following individuals are "Required" (based on income) or "Not required to file a tax return for 2019. Click here to access the standard deduction tables to use. Required / Not Required Fred and April are married and file jointly. Fred is 64, and April, aged 58, is legally blind. Their combined gross income is $25,000. b. Christina, aged 65, received $3,000 in earned income. She is claimed as a dependent by her son. Gerald, aged 73, files single. He is legally blind and has gross income of $13,000. d. Jessica-Anne, aged 35, files as head of household. Her gross income is $12,800. C

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts