Question: Problem 3-42 (LO. 6, 8) During the year, Inez, a single individual, recorded the following transactions involving capital assets. Gain on the sale of unimproved

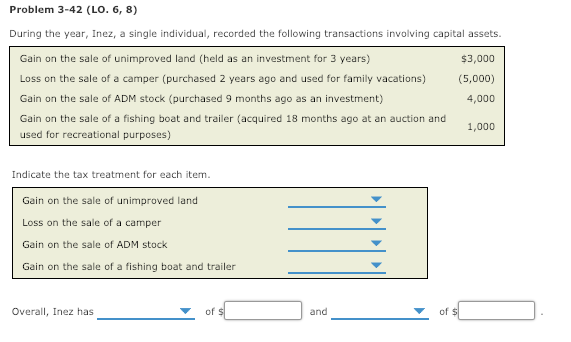

Problem 3-42 (LO. 6, 8) During the year, Inez, a single individual, recorded the following transactions involving capital assets. Gain on the sale of unimproved land (held as an investment for 3 years) Loss on the sale of a camper (purchased 2 years ago and used for family vacations) Gain on the sale of ADM stock (purchased 9 months ago as an investment) Gain on the sale of a fishing boat and trailer (acquired 18 months ago at an auction and used for recreational purposes) $3,000 (5,000) 4,000 1,000 Indicate the tax treatment for each item. Gain on the sale of unimproved land Loss on the sale of a camper Gain on the sale of ADM stock Gain on the sale of a fishing boat and trailer Overall, Inez has of and of $

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts