Question: Problem 3.5. Volatility smile or volatility skew refers to the relation between implied volatil ity and strike price (Hull chapter 19). Quotes for selected options

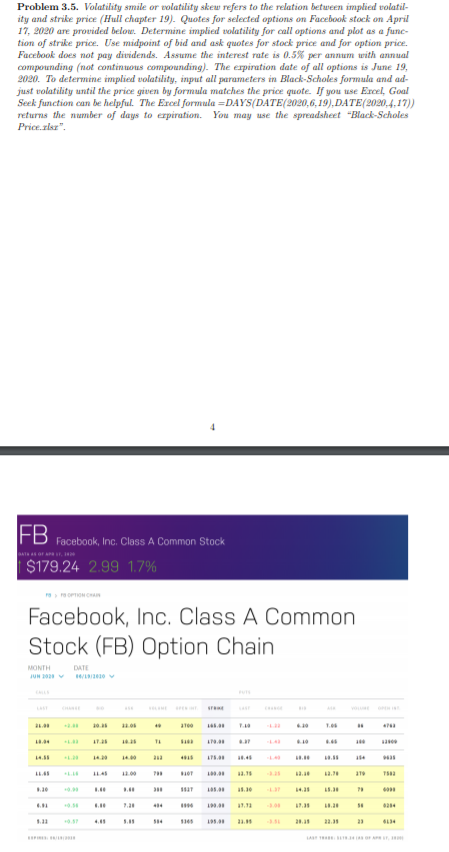

Problem 3.5. Volatility smile or volatility skew refers to the relation between implied volatil ity and strike price (Hull chapter 19). Quotes for selected options on Facebook stock on April 17, 2020 are provided below. Determine implied volatility for all options and plot as a func tion of strike price. Use midpoint of bid and ask quotes for stock price and for option price Facebook does not pay dividends. Assume the interest rate is 0.5% per annum with annual compounding (not continuous compounding). The expiration date of all options is June 19, 2020. To determine implied volatility, input all parameters in Black-Scholes formula and ad- just volatility until the price given by formula matches the price quote If you use Ercel, Goal Seek function can be helpful The Ercel formula =DAYS/DATE (2020,6,19), DATE (2020.4.17) returns the number of days to erpiration. You may use the spreadsheet Black Scholes FB Facebook, Inc. Class A Common Stock $179.24 2.99 1.7% Facebook, Inc. Class A Common Stock (FB) Option Chain I 3.15 . 279 Problem 3.5. Volatility smile or volatility skew refers to the relation between implied volatil ity and strike price (Hull chapter 19). Quotes for selected options on Facebook stock on April 17, 2020 are provided below. Determine implied volatility for all options and plot as a func tion of strike price. Use midpoint of bid and ask quotes for stock price and for option price Facebook does not pay dividends. Assume the interest rate is 0.5% per annum with annual compounding (not continuous compounding). The expiration date of all options is June 19, 2020. To determine implied volatility, input all parameters in Black-Scholes formula and ad- just volatility until the price given by formula matches the price quote If you use Ercel, Goal Seek function can be helpful The Ercel formula =DAYS/DATE (2020,6,19), DATE (2020.4.17) returns the number of days to erpiration. You may use the spreadsheet Black Scholes FB Facebook, Inc. Class A Common Stock $179.24 2.99 1.7% Facebook, Inc. Class A Common Stock (FB) Option Chain I 3.15 . 279

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts