Question: Problem 3-55 (Algo) CVP, Operating Leverage, and Margin of Safety (LO 3-1, 3, 4) Lemon Ltd. offers executive training seminars using, in part, recorded lectures

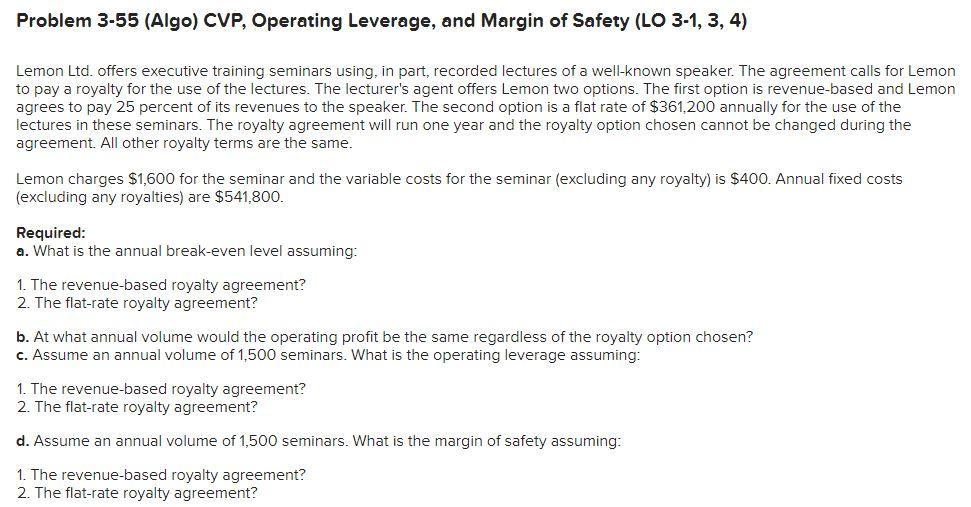

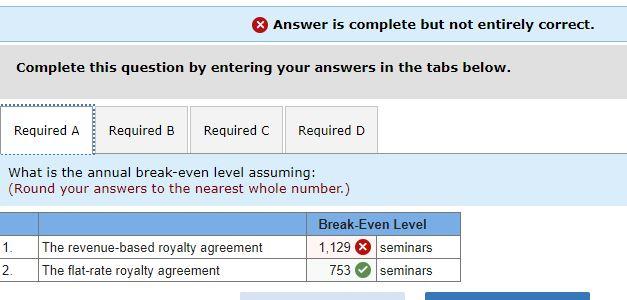

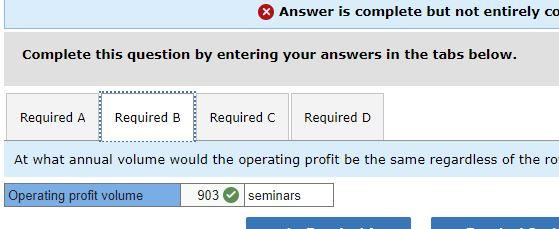

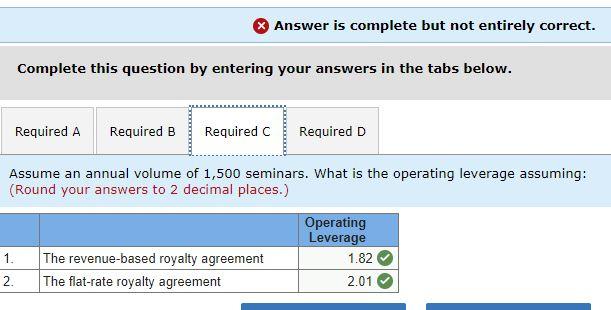

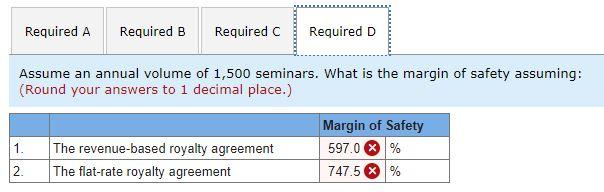

Problem 3-55 (Algo) CVP, Operating Leverage, and Margin of Safety (LO 3-1, 3, 4) Lemon Ltd. offers executive training seminars using, in part, recorded lectures of a well-known speaker. The agreement calls for Lemon to pay a royalty for the use of the lectures. The lecturer's agent offers Lemon two options. The first option is revenue-based and Lemon agrees to pay 25 percent of its revenues to the speaker. The second option is a flat rate of $361,200 annually for the use of the lectures in these seminars. The royalty agreement will run one year and the royalty option chosen cannot be changed during the agreement. All other royalty terms are the same. Lemon charges $1,600 for the seminar and the variable costs for the seminar (excluding any royalty) is $400. Annual fixed costs (excluding any royalties) are $541,800. Required: a. What is the annual break-even level assuming: 1. The revenue-based royalty agreement? 2. The flat-rate royalty agreement? b. At what annual volume would the operating profit be the same regardless of the royalty option chosen? c. Assume an annual volume of 1,500 seminars. What is the operating leverage assuming: 1. The revenue-based royalty agreement? 2. The flat-rate royalty agreement? d. Assume an annual volume of 1,500 seminars. What is the margin of safety assuming: 1. The revenue-based royalty agreement? 2. The flat-rate royalty agreement? Answer is complete but not entirely correct. Complete this question by entering your answers in the tabs below. Required A Required B Required C Required D What is the annual break-even level assuming: (Round your answers to the nearest whole number.) 1. 2 The revenue-based royalty agreement The flat-rate royalty agreement Break-Even Level 1,129 seminars 753 seminars Answer is complete but not entirely co Complete this question by entering your answers in the tabs below. Required A Required B Required Required D At what annual volume would the operating profit be the same regardless of the ro Operating profit volume 903 seminars Answer is complete but not entirely correct. Complete this question by entering your answers in the tabs below. Required a Required B Required C Required D Assume an annual volume of 1,500 seminars. What is the operating leverage assuming: (Round your answers to 2 decimal places.) 1. 2. The revenue-based royalty agreement The flat-rate royalty agreement Operating Leverage 1.82 2.01 Required A Required B Required C Required D Assume an annual volume of 1,500 seminars. What is the margin of safety assuming: (Round your answers to 1 decimal place.) 1. The revenue-based royalty agreement The flat-rate royalty agreement Margin of Safety 597.0 % % 747.5 % 2

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts