Question: Problem 3-5A Preparing financial statements from the adjusted trial balance and calculating profit margin P3 Al A2 Callahay Company started business before the current year

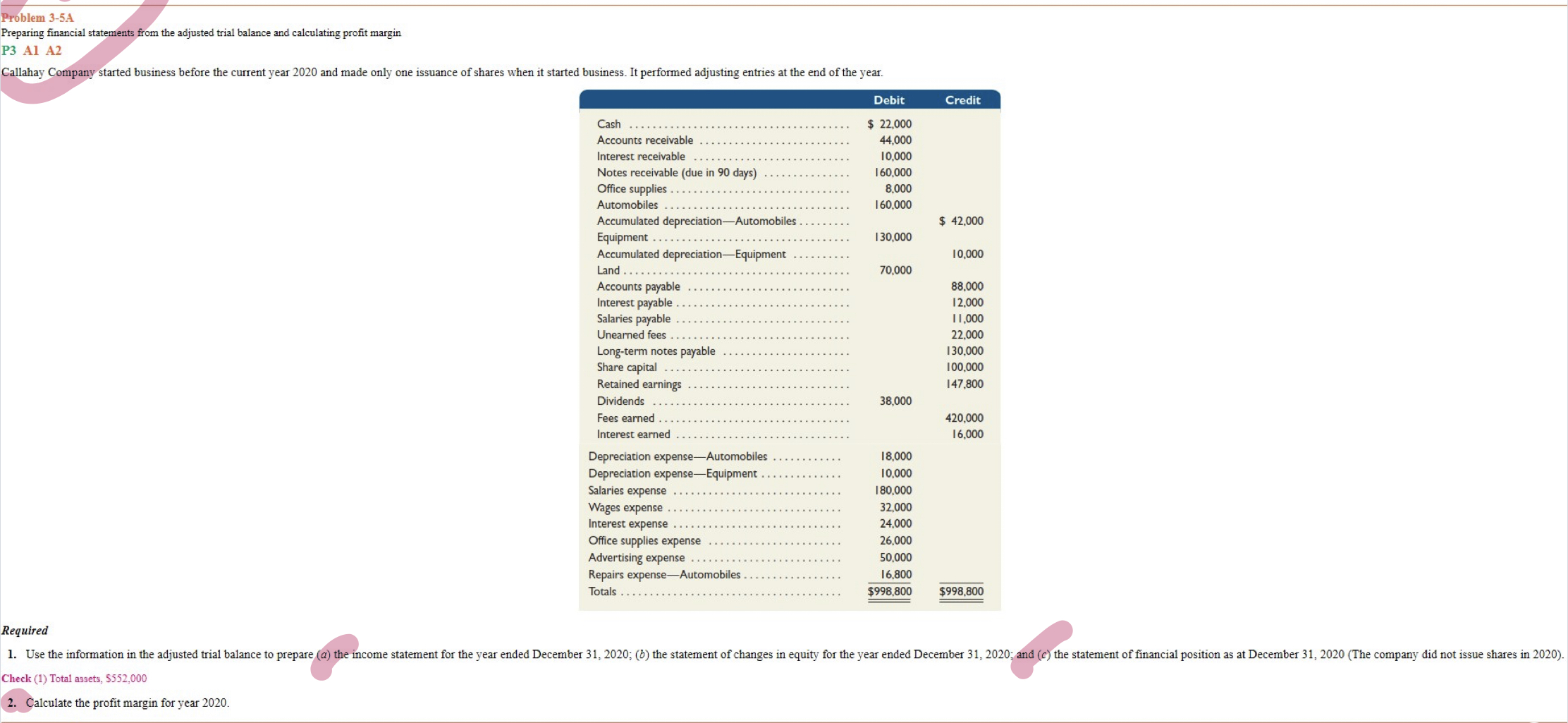

Problem 3-5A Preparing financial statements from the adjusted trial balance and calculating profit margin P3 Al A2 Callahay Company started business before the current year 2020 and made only one issuance of shares when it started business. It performed adjusting entries at the end of the year. Debit Credit Cash . . . . . . . . . . $ 22,000 Accounts receivable 44,000 Interest receivable 10,000 Notes receivable (due in 90 days) .... . . . 160,000 Office supplies ... . . . 8,000 Automobiles 160,000 Accumulated depreciation-Automobiles . .. .. . . . . $ 42,000 Equipment . .. .. . 130.000 Accumulated depreciation-Equipment . . . . . . . . . . 10.000 Land . ... .. 70.000 Accounts payable . . . . . . 88,000 Interest payable . . . . . . 12,000 Salaries payable 1 1,000 Unearned fees . 22.000 Long-term notes payable 130,000 Share capital 100.000 Retained earnings . 147.800 Dividends 38,000 Fees earned . . . . . . 420,000 Interest earned . . . . . . . . . . . . . 16,000 Depreciation expense-Automobiles . 18,000 Depreciation expense-Equipment . 10,000 Salaries expense 180,000 Wages expense . 32,000 Interest expense 24.000 Office supplies expense 26,000 Advertising expense . . . . . 50,000 Repairs expense-Automobiles . 16,800 Totals .. . . . . . . . . . . . . . $998,800 $998,800 Required 1. Use the information in the adjusted trial balance to prepare (a) the income statement for the year ended December 31, 2020; (b) the statement of changes in equity for the year ended December 31, 2020; and (c) the statement of financial position as at December 31, 2020 (The company did not issue shares in 2020). Check (1) Total assets, $552,000 2. Calculate the profit margin for year 2020

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts