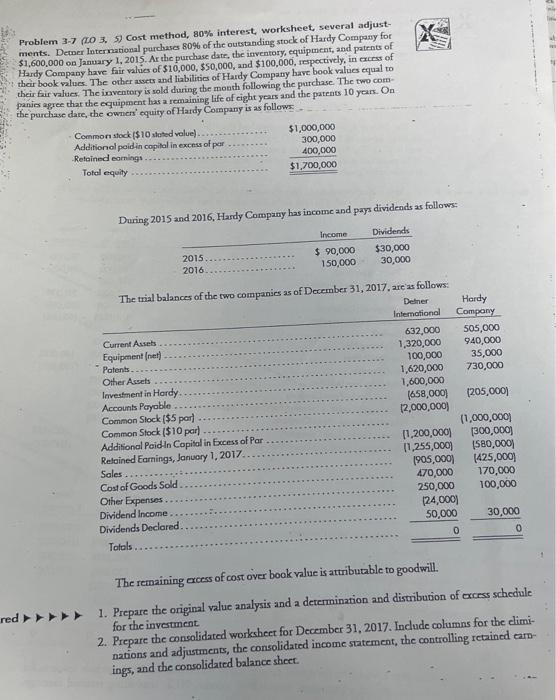

Question: Problem 3-7 (20 3, 5) Cost method, 80% interest, worksheet several adjustments. Detner International purchases 80% of the outstanding stock of Hardy Company for $1,600,000

Problem 3-7 (20 3, 5) Cost method, 80% interest, worksheet several adjustments. Detner International purchases 80% of the outstanding stock of Hardy Company for $1,600,000 on Jamary 1,2015 . Ar the purchase date, the inventory, equipment, and patents of Hardy Company have fair values of $10,000,$50,000, and $100,000, ropectively, in excess of their book values. The other assets and liabilities of Hardy Company have book values equal to their fair values. The iraventory is sold during the month following the purchase. The two companios agree that the equipment has a remaining life of eight years and the patents 10 yors. On the purchase dare, the owners' equity of Hardy Company is as follows: During 2015 and 2016, Hardy Company has income and pays dividends as follows: The remaining excess of cost over book value is attributable to goodwill. 1. Prepare the original value analysis and a derermination and distriburion of excess schedule for the inverment: 2. Prepare the consolidated worksheet for December 31, 2017. Indude columns for the eliminations and adjustments, the consolidated income statement, the controlling retained earpings, and the consolidated balance sheet

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts