Question: Problem 3-7 (L03.3) Using the tax table, determine the amount of taxes for the following situations: (Do not round intermediate calculations. Round your answers to

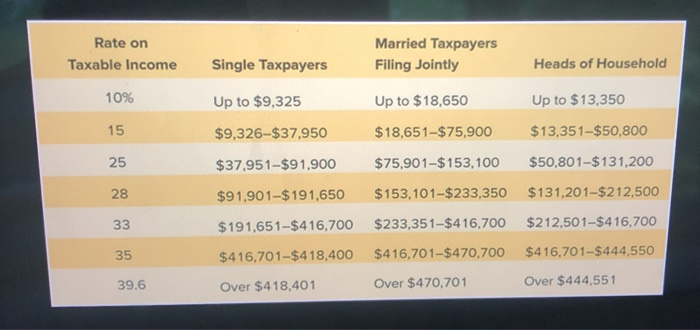

Problem 3-7 (L03.3) Using the tax table, determine the amount of taxes for the following situations: (Do not round intermediate calculations. Round your answers to 2 decimal places.) a. A head of household with taxable income of $55,000 Tax amount b. A single person with taxable income of $35,000 Tax amount $ 4.875.00 c. Married taxpayers filing jointly with taxable income of $72.000. Tax amount Rate on Taxable income Married Taxpayers Filing Jointly Single Taxpayers Heads of Household 10% Up to $9,325 Up to $13,350 Up to $18,650 $18,651-$75,900 15 $9,326-$37,950 $13,351-$50.800 25 $37,951-$91,900 $75,901-$153,100 $50,801-$131,200 28 $91,901-$191,650 $153,101-$233,350 $131,201-$212,500 33 $191,651-$416,700 $233,351-$416,700 $212,501-$416,700 35 $416,701-$418,400 $416,701-$470.700 $416,701-$444,550 39.6 Over $418,401 Over $470.701 Over $444,551

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts