Question: Problem 3-70A Part I Comprehensive Problem: Reviewing the Accounting Cycle Tarkington Freight Service provides delivery of merchandise to retail grocery stores in the Northeast. At

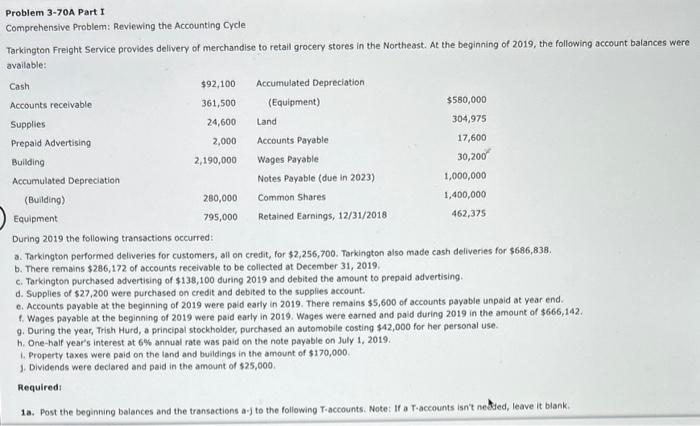

Problem 3-70A Part I Comprehensive Problem: Reviewing the Accounting Cycle Tarkington Freight Service provides delivery of merchandise to retail grocery stores in the Northeast. At the beginning of 2019 , the following account balances were available: During 2019 the following transactions occurred: a. Tarkington performed deliveries for customers, all on credit, for $2,256,700. Torkington also made cash deliveries for $686,838. b. There remains $286,172 of accounts receivable to be collected at December 31,2019. c. Tarkington purchased advertising of $138,100 during 2019 and debited the amount to prepaid advertising. d. Supplies of $27,200 were purchased on credit and debited to the supplies account. e. Accounts payable at the beginning of 2019 were paid early in 2019 . There remains $5,600 of accounts payable unpaid at year end. f. Wages payable at the beginning of 2019 were paid early in 2019. Wages were earned and pald during 2019 in the amount of $666,142. 9. During the year, Trish Hurd, a principal stockholder, purchased an automobile costing $42,000 for her personal use. h. One-half year's interest at 6% annual rate was paid on the note payable on July 1,2019. 1. Property taxes were paid on the land and buildings in the amount of $170,000. 1. Dividends were deciared and paid in the amount of $25,000. Required: 13. Post the beginning balances and the transactions a-j to the following T-accounts. Note: If a Traccounts isn't neetied, leave it blank

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts