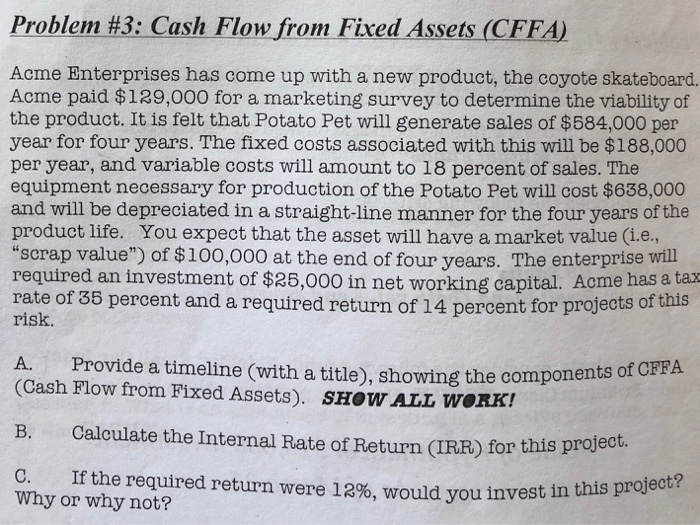

Question: Problem #3:Cash Flow from Fixed Assets (CFFA) Acme Enterprises has come up with a new product, the coyote skateboard. Acme paid $129,000 for a marketing

Problem #3:Cash Flow from Fixed Assets (CFFA) Acme Enterprises has come up with a new product, the coyote skateboard. Acme paid $129,000 for a marketing survey to determine the viability of the product. It is felt that Potato Pet will generate sales of $584,000 per year for four years. The fixed costs associated with this will be $188,000 per year, and variable costs will amount to 18 percent of sales. The equipment necessary for production of the Potato Pet will cost $638,000 and will be depreciated in a straight-line manner for the four years of the product life. You expect that the asset will have a market value (l.e., scrap value") of $100,000 at the end of four years. The enterprise wil required an investment of $25,000 in net working capital. Acme has a tax rate of 35 percent and a required return of 14 percent for projects of ns risk. A. Provide a timeline (with a title), showing the componen (Cash Flow from Fixed Assets). SHOw ALL wORK! e components of CFFA Calculate the Internal Rate of Return (IRR) for this p If the required return were 12%, would you invest in B. Why or why not

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts