Question: Problem 4 - 1 4 ( Algo ) ( LO 4 - 2 , 4 - 4 , 4 - 5 ) On January 1

Problem AlgoLO

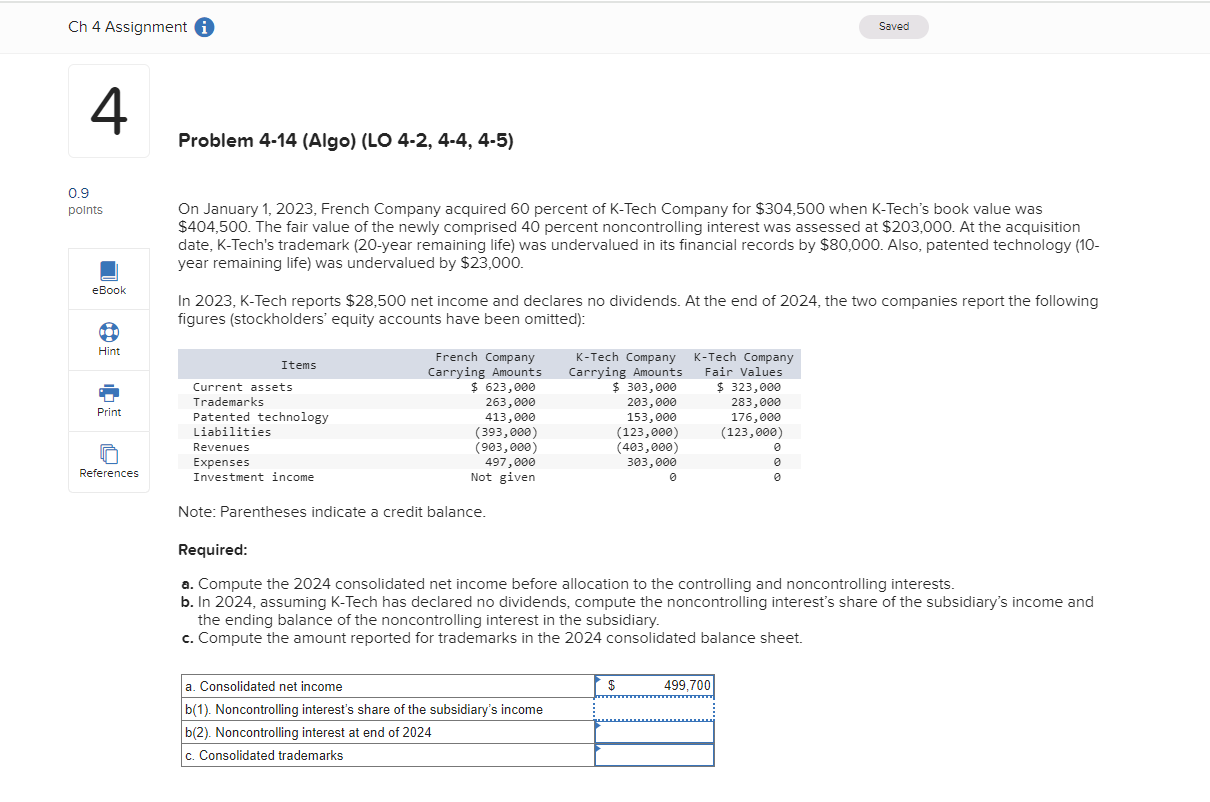

On January French Company acquired percent of KTech Company for $ when KTech's book value was

$ The fair value of the newly comprised percent noncontrolling interest was assessed at $ At the acquisition

date, KTech's trademark year remaining life was undervalued in its financial records by $ Also, patented technology

year remaining life was undervalued by $

In KTech reports $ net income and declares no dividends. At the end of the two companies report the following

figures stockholders equity accounts have been omitted:

Note: Parentheses indicate a credit balance.

Required:

a Compute the consolidated net income before allocation to the controlling and noncontrolling interests.

b In assuming KTech has declared no dividends, compute the noncontrolling interest's share of the subsidiary's income and

the ending balance of the noncontrolling interest in the subsidiary.

c Compute the amount reported for trademarks in the consolidated balance sheet.

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock