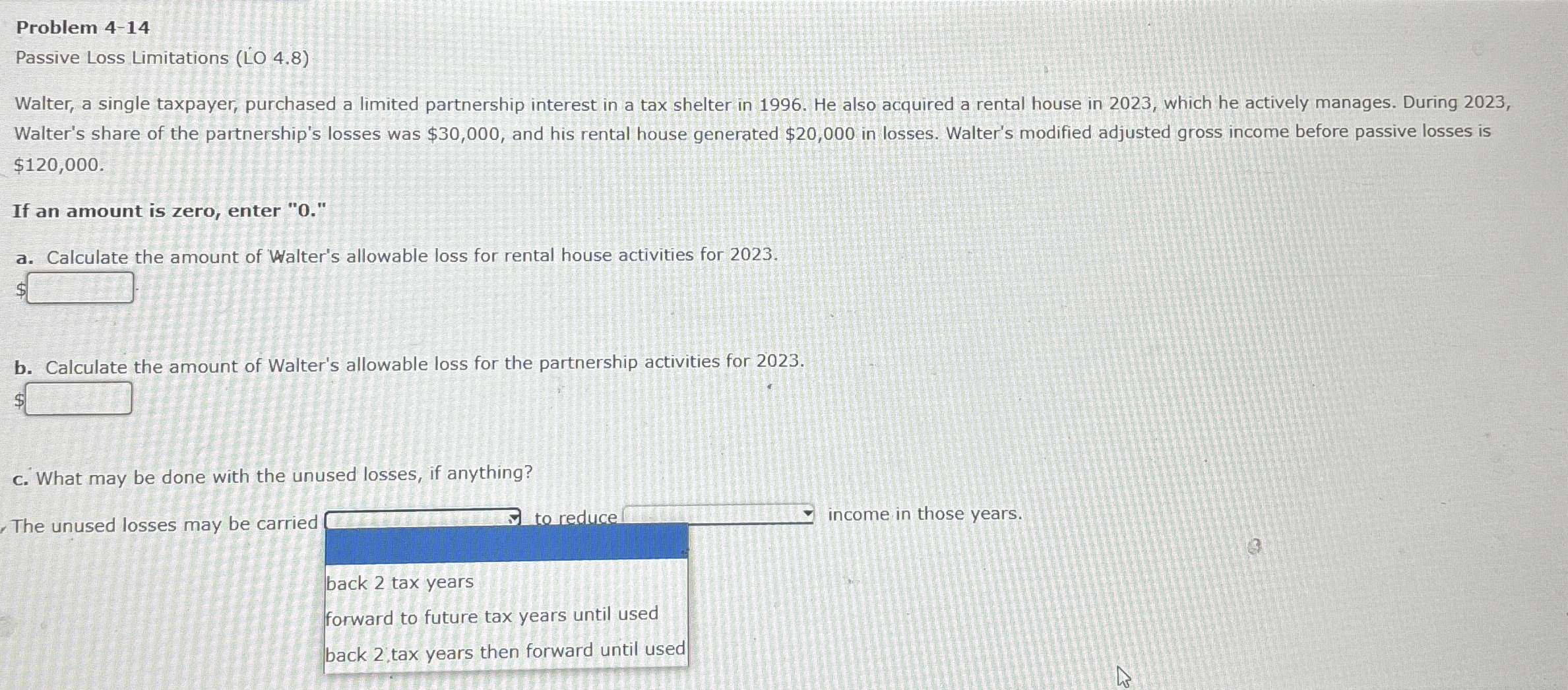

Question: Problem 4 - 1 4 Passive Loss Limitations ( LO 4 . 8 ) Walter, a single taxpayer, purchased a limited partnership interest in a

Problem

Passive Loss Limitations LO

Walter, a single taxpayer, purchased a limited partnership interest in a tax shelter in He also acquired a rental house in which he actively manages. During

Walter's share of the partnership's losses was $ and his rental house generated $ in losses. Walter's modified adjusted gross income before passive losses is

$

If an amount is zero, enter

a Calculate the amount of Walter's allowable loss for rental house activities for

$

b Calculate the amount of Walter's allowable loss for the partnership activities for

$

c What may be done with the unused losses, if anything?

The unused losses may be carried

to reduce

income in those years.

back tax years

forward to future tax years until used

back tax years then forward until used

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock