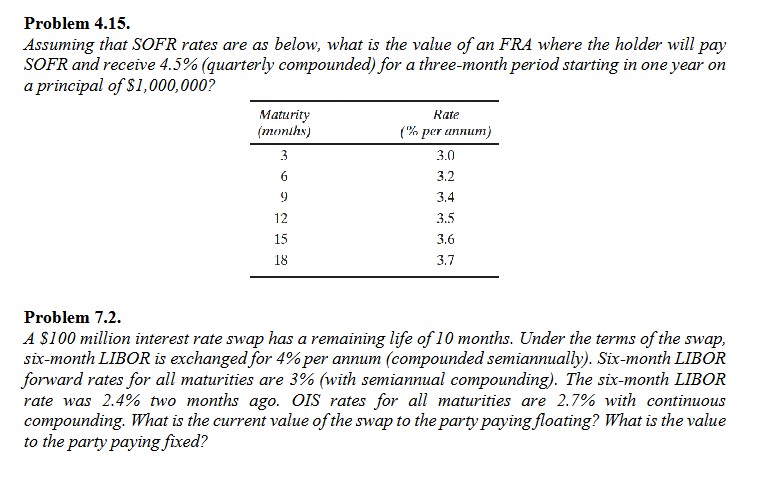

Question: Problem 4 . 1 5 . Assuming that SOFR rates are as below, what is the value of an FRA where the holder will pay

Problem Assuming that SOFR rates are as below, what is the value of an FRA where the holder will pay SOFR and receive quarterly compounded for a threemonth period starting in one year on a principal of $ Problem A $ million interest rate swap has a remaining life of months. Under the terms of the swap, sixmonth LIBOR is exchanged for per annum compounded semiannually Sixmonth LIBOR forward rates for all maturities are with semiannual compounding The sixmonth LIBOR rate was two months ago. OIS rates for all maturities are with continuous compounding. What is the current value of the swap to the party paying floating? What is the value to the party paying fixed?

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock