Question: Problem 4 ( 1 5 points ) During all of 2 0 2 4 , Mr . and Mrs . Clay lived with their four

Problem points

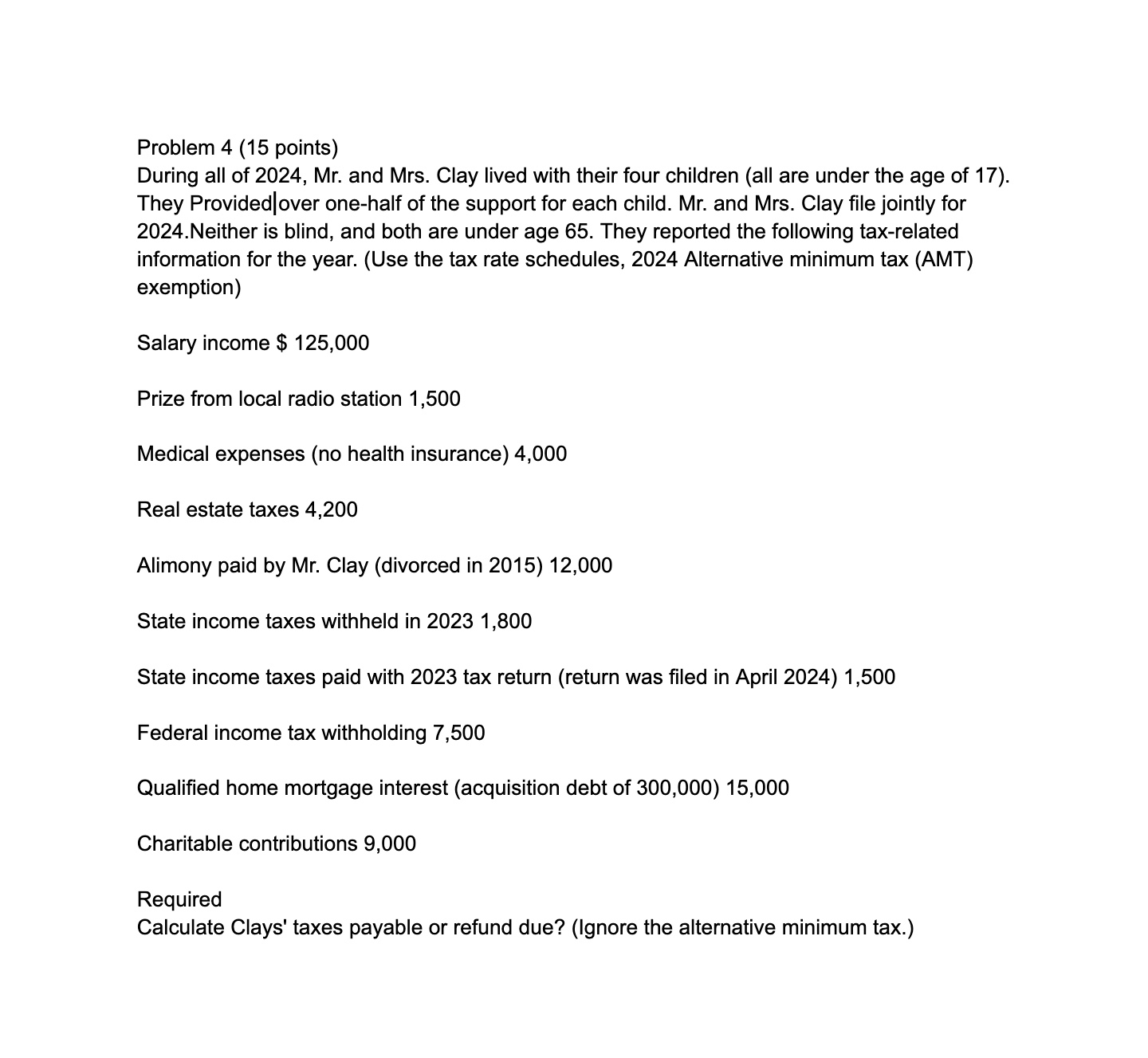

During all of Mr and Mrs Clay lived with their four children all are under the age of They Provided over onehalf of the support for each child. Mr and Mrs Clay file jointly for Neither is blind, and both are under age They reported the following taxrelated information for the year. Use the tax rate schedules, Alternative minimum tax AMT exemption

Salary income $

Prize from local radio station

Medical expenses no health insurance

Real estate taxes

Alimony paid by Mr Clay divorced in

State income taxes withheld in

State income taxes paid with tax return return was filed in April

Federal income tax withholding

Qualified home mortgage interest acquisition debt of

Charitable contributions

Required

Calculate Clays' taxes payable or refund due? Ignore the alternative minimum tax.

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock