Question: Problem 4 - 1 6 ( Algo ) ( LO 4 - 3 , 4 - 4 , 4 - 5 ) On January 1

Problem AlgoLO

On January Pasture Company acquires of Spring Company for $ in cash consideration. The remaining percent noncontrolling interest shares had an acquisitiondate estimated fair value of $ Spring's acquisitiondate total book value was $

The fair value of Spring's recorded assets and liabilities equaled their carrying amounts. However, Spring had two unrecorded assetsa trademark with an indefinite life and estimated fair value of $ and licensing agreements estimated to be worth $ with fouryear remaining lives. Any remaining acquisitiondate fair value in the Spring acquisition was considered goodwill,

During Spring reported $ net income and declared and paid dividends totaling $ Also in Pasture reported $ net income, but neither declared nor paid dividends.

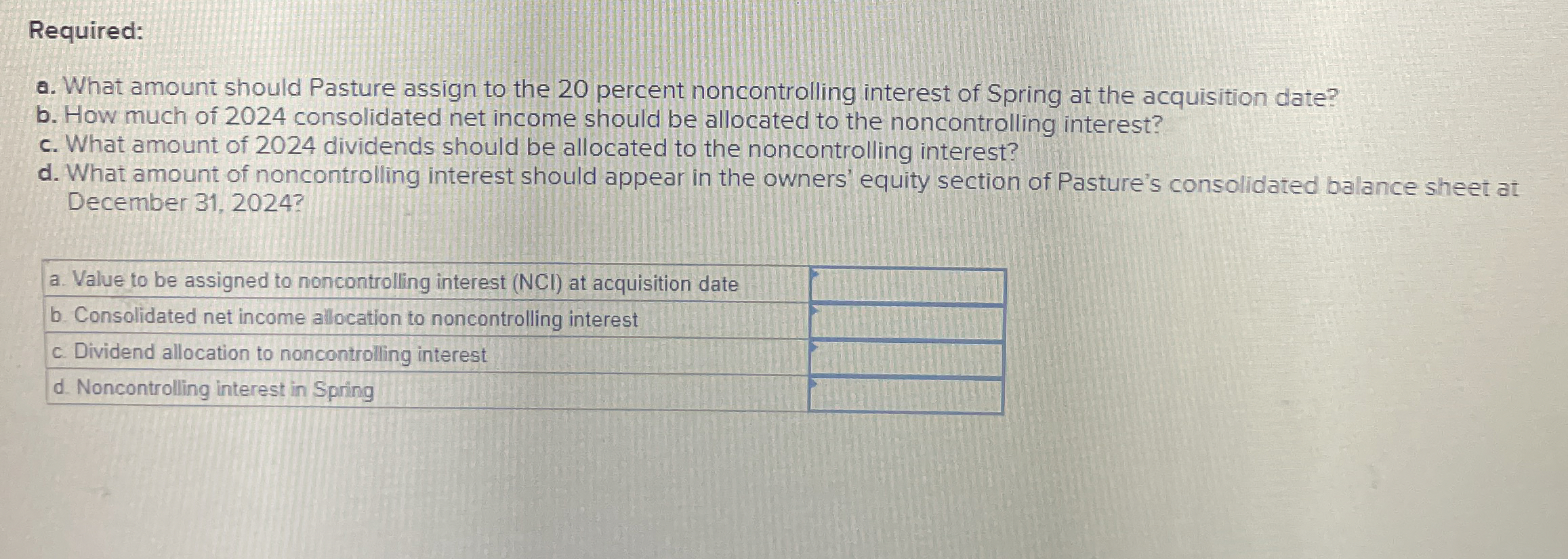

Required:

a What amount should Pasture assign to the percent noncontrolling interest of Spring at the acquisition date?

b How much of consolidated net income should be allocated to the noncontrolling interest?

c What amount of dividends should be allocated to the noncontrolling interest?

d What amount of noncontrolling interest should appear in the owners' equity section of Pasture's consolidated balance sheet at December

a Value to be assigned to noncontrolling interest at acquisition date

Required:

a What amount should Pasture assign to the percent noncontrolling interest of Spring at the acquisition date?

b How much of consolidated net income should be allocated to the noncontrolling interest?

c What amount of dividends should be allocated to the noncontrolling interest?

d What amount of noncontrolling interest should appear in the owners' equity section of Pasture's consolidated balance sheet at December

a Value to be assigned to noncontrolling interest NCI at acquisition date

b Consolidated net income allocation to noncontrolling interest

c Dividend allocation to noncontrolling interest

d Noncontrolling interest in Spring

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock