Question: Problem 4 (10 points): Goal Programming AQC Investment Services must develop an investment portfolio for a new client. As an initial investment strategy, the new

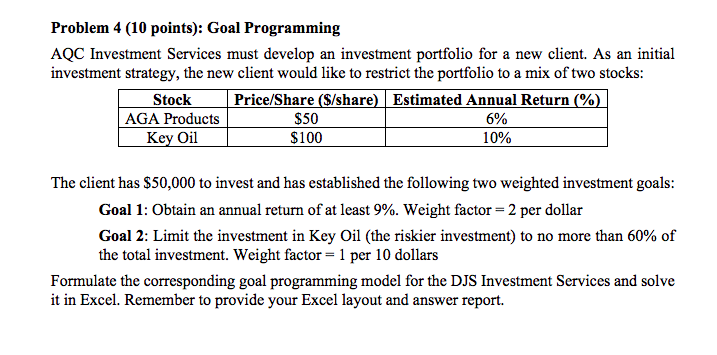

Problem 4 (10 points): Goal Programming AQC Investment Services must develop an investment portfolio for a new client. As an initial investment strategy, the new client would like to restrict the portfolio to a mix of two stocks: Price/Share (S/share) Estimated Annual Return (%) Stock $50 $100 AGA Products 6% Key Oil 10% The client has $50,000 to invest and has established the following two weighted investment goals: Goal 1: Obtain an annual return of at least 9%. Weight factor = 2 per dollar Goal 2: Limit the investment in Key Oil (the riskier investment) to no more than 60% of the total investment. Weight factor = 1 per 10 dollars Formulate the corresponding goal programming model for the DJS Investment Services and solve it in Excel. Remember to provide your Excel layout and answer report Problem 4 (10 points): Goal Programming AQC Investment Services must develop an investment portfolio for a new client. As an initial investment strategy, the new client would like to restrict the portfolio to a mix of two stocks: Price/Share (S/share) Estimated Annual Return (%) Stock $50 $100 AGA Products 6% Key Oil 10% The client has $50,000 to invest and has established the following two weighted investment goals: Goal 1: Obtain an annual return of at least 9%. Weight factor = 2 per dollar Goal 2: Limit the investment in Key Oil (the riskier investment) to no more than 60% of the total investment. Weight factor = 1 per 10 dollars Formulate the corresponding goal programming model for the DJS Investment Services and solve it in Excel. Remember to provide your Excel layout and answer report

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts