Question: Problem 4 (10 Points) Recall that the problem of finding an arbitrage opportunity in a market with N assets whose prices are given as PERN

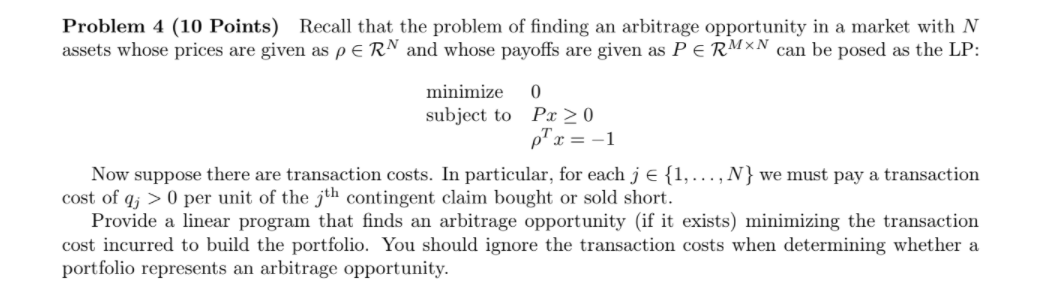

Problem 4 (10 Points) Recall that the problem of finding an arbitrage opportunity in a market with N assets whose prices are given as PERN and whose payoffs are given as PERMXN can be posed as the LP: minimize 0 subject to P: > 0 PT x = -1 Now suppose there are transaction costs. In particular, for each je {1,...,N} we must pay a transaction cost of q; > 0 per unit of the jth contingent claim bought or sold short. Provide a linear program that finds an arbitrage opportunity (if it exists) minimizing the transaction cost incurred to build the portfolio. You should ignore the transaction costs when determining whether a portfolio represents an arbitrage opportunity

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts