Question: Problem 4 (12 marks) MAC would like to raise $20,000,000 for capital expenditures. The company plans to issue 15 year, semi-annual pay bonds with a

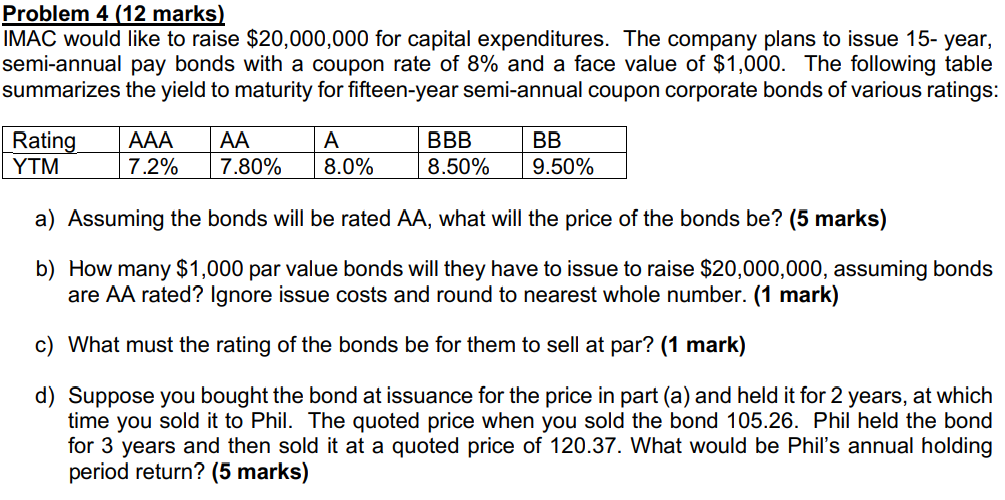

Problem 4 (12 marks) MAC would like to raise $20,000,000 for capital expenditures. The company plans to issue 15 year, semi-annual pay bonds with a coupon rate of 8% and a face value of $1,000. The following table summarizes the yield to maturity for fifteen-year semi-annual coupon corporate bonds of various ratings: a) Assuming the bonds will be rated AA, what will the price of the bonds be? (5 marks) b) How many $1,000 par value bonds will they have to issue to raise $20,000,000, assuming bonds are AA rated? Ignore issue costs and round to nearest whole number. (1 mark) c) What must the rating of the bonds be for them to sell at par? (1 mark) d) Suppose you bought the bond at issuance for the price in part (a) and held it for 2 years, at which time you sold it to Phil. The quoted price when you sold the bond 105.26. Phil held the bond for 3 years and then sold it at a quoted price of 120.37. What would be Phil's annual holding period return

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts