Question: Problem 4 (12 points) Deltan Co. began operations in 2020. The following data relates to Deltan's 2020 operations: Pretax financial income is $1,000,000. The tax

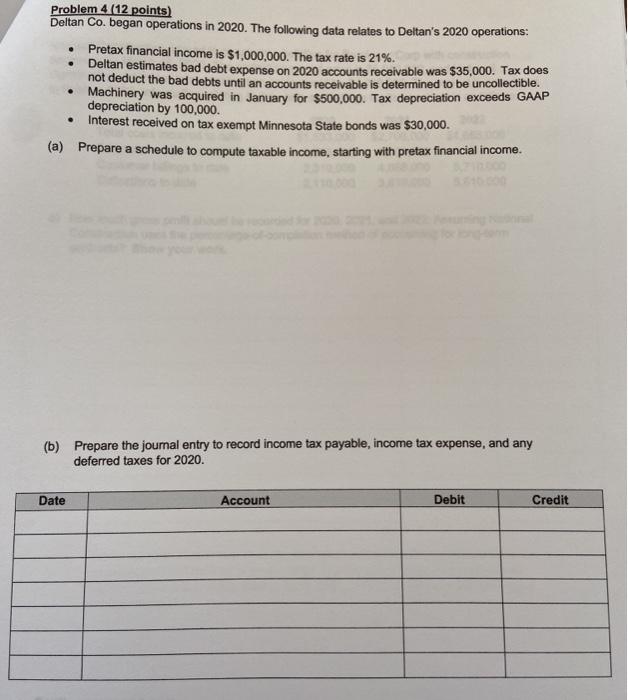

Problem 4 (12 points) Deltan Co. began operations in 2020. The following data relates to Deltan's 2020 operations: Pretax financial income is $1,000,000. The tax rate is 21%. Deltan estimates bad debt expense on 2020 accounts receivable was $35,000. Tax does not deduct the bad debts until an accounts receivable is determined to be uncollectible. Machinery was acquired in January for $500,000. Tax depreciation exceeds GAAP depreciation by 100,000. Interest received on tax exempt Minnesota State bonds was $30,000 (a) Prepare a schedule to compute taxable income, starting with pretax financial income. . (b) Prepare the journal entry to record income tax payable, income tax expense, and any deferred taxes for 2020. Date Account Debit Credit

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts