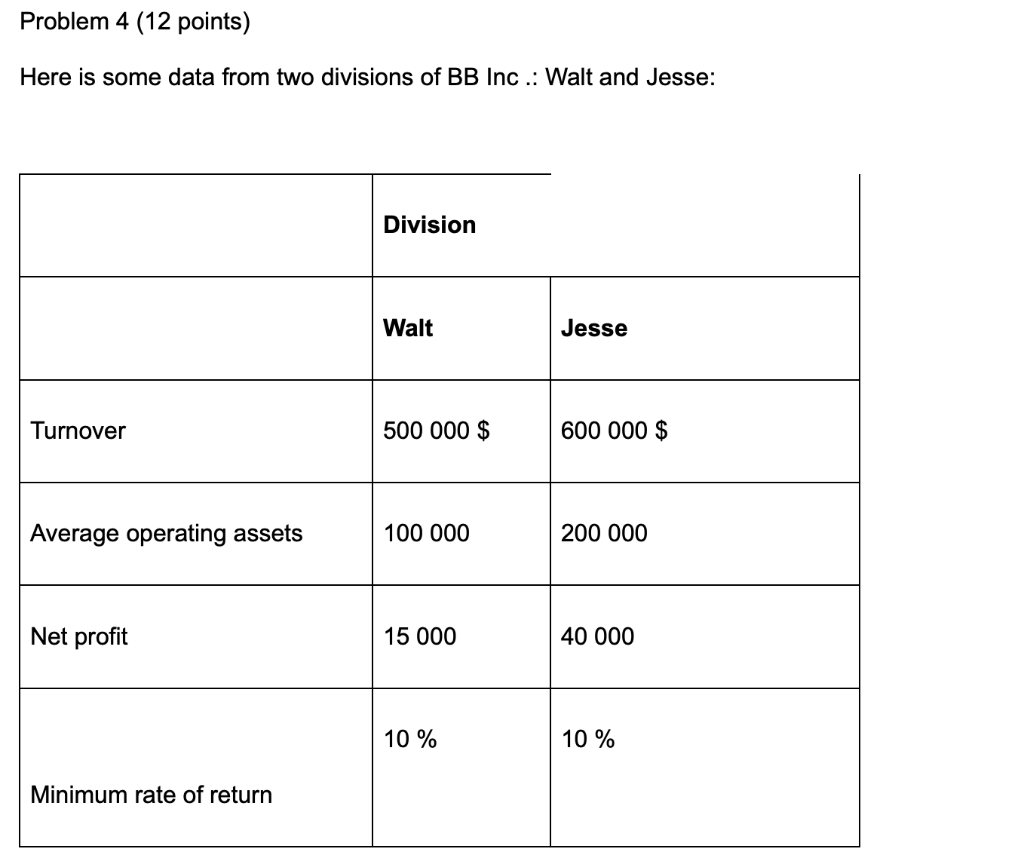

Question: Problem 4 (12 points) Here is some data from two divisions of BB Inc .: Walt and Jesse: Division Walt Jesse Turnover 500 000 $

Problem 4 (12 points) Here is some data from two divisions of BB Inc .: Walt and Jesse: Division Walt Jesse Turnover 500 000 $ 600 000 $ Average operating assets 100 000 200 000 Net profit 15 000 40 000 10 % 10 % Minimum rate of return Work to do: 1. Calculate the ROI rate for each division. (2 pts) 2. Now suppose that BB inc. has decided to value the Jesse division on the basis of residual net income, using a minimum required rate of return of 10% and that the Walt division will continue to be measured on the basis of ROIC. Calculate the RNR for Jesse's division. (2 pts) 3. Now assume that each of the divisions has the opportunity to complete a new project requiring an investment of $ 20,000 in operating assets, which will result in an increase of $ 2,500 in net operating income. a) Calculate the ROI of the Walt division for the new project. Should the Walt Division accept this investment? (3 pts) b) Calculate the ROI of Jesse's division for the new project. Should the Jesse Division accept this investment? (3 pts) 4. Is it in BB Inc.'s best interests to accept this project? (2 pts)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts