Question: Problem 4 (13 points) Consider an investment project whose continuation value at the end of the period is either 200M or 150M. The project can

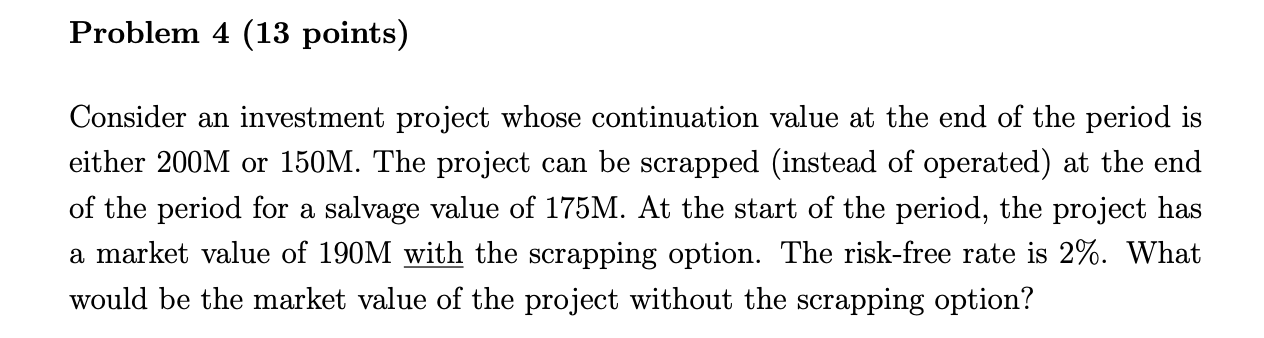

Problem 4 (13 points) Consider an investment project whose continuation value at the end of the period is either 200M or 150M. The project can be scrapped (instead of operated) at the end of the period for a salvage value of 175M. At the start of the period, the project has a market value of 190M with the scrapping option. The risk-free rate is 2%. What would be the market value of the project without the scrapping option? Problem 4 (13 points) Consider an investment project whose continuation value at the end of the period is either 200M or 150M. The project can be scrapped (instead of operated) at the end of the period for a salvage value of 175M. At the start of the period, the project has a market value of 190M with the scrapping option. The risk-free rate is 2%. What would be the market value of the project without the scrapping option

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts