Question: Problem 4 (14 marks) You just bought a 5-year Treasury bond with a 4 year term, a face value of $1,000 and a coupon rate

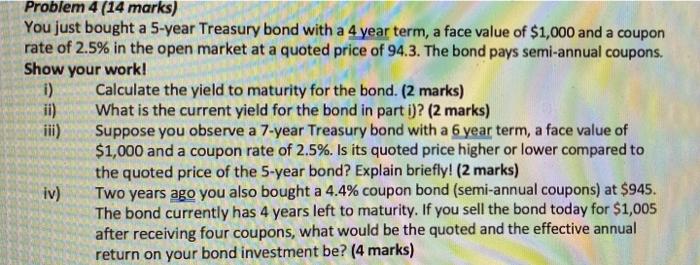

Problem 4 (14 marks) You just bought a 5-year Treasury bond with a 4 year term, a face value of $1,000 and a coupon rate of 2.5% in the open market at a quoted price of 94.3. The bond pays semi-annual coupons. Show your work! i) Calculate the yield to maturity for the bond. (2 marks) What is the current yield for the bond in part 1)? (2 marks) Suppose you observe a 7-year Treasury bond with a 6 year term, a face value of $1,000 and a coupon rate of 2.5%. Is its quoted price higher or lower compared to the quoted price of the 5-year bond? Explain briefly! (2 marks) iv) Two years ago you also bought a 4.4% coupon bond (semi-annual coupons) at $945. The bond currently has 4 years left to maturity. If you sell the bond today for $1,005 after receiving four coupons, what would be the quoted and the effective annual return on your bond investment be? (4 marks)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts