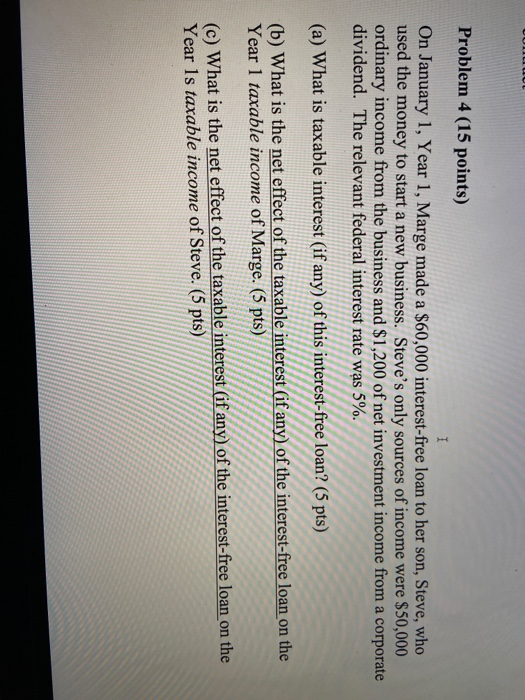

Question: Problem 4 (15 points) I On January 1, Year 1, Marge made a $60,000 interest-free loan to her son, Steve, who used the money to

Problem 4 (15 points) I On January 1, Year 1, Marge made a $60,000 interest-free loan to her son, Steve, who used the money to start a new business. Steve's only sources of income were $50,000 ordinary income from the business and $1,200 of net investment income from a corporate dividend. The relevant federal interest rate was 5%. (a) What is taxable interest (if any) of this interest-free loan? (5 pts) (b) What is the net effect of the taxable interest (if any) of the interest-free loan on the Year 1 taxable income of Marge. (5 pts) (c) What is the net effect of the taxable interest (if any) of the interest-free loan on the Year 1s taxable income of Steve. (5 pts)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts