Question: Problem 4 (15 Points) Mets Construction enters into a contract with a customer to build a warehouse for $900,000 on March 30, 2019 with a

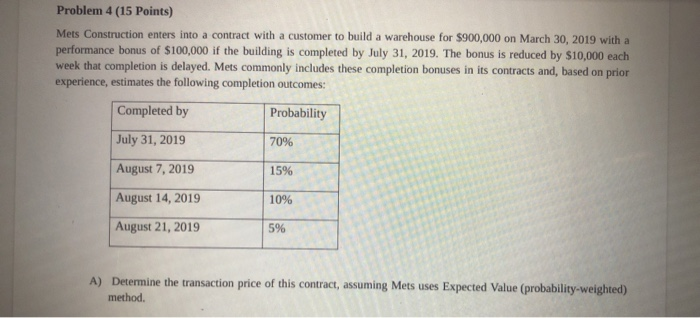

Problem 4 (15 Points) Mets Construction enters into a contract with a customer to build a warehouse for $900,000 on March 30, 2019 with a performance bonus of $100,000 if the building is completed by July 31, 2019. The bonus is reduced by $10,000 each week that completion is delayed. Mets commonly includes these completion bonuses in its contracts and, based on prior experience, estimates the following completion outcomes: Completed by Probability July 31, 2019 70% August 7, 2019 15% August 14, 2019 10% August 21, 2019 5% A) Determine the transaction price of this contract, assuming Mets uses Expected Value (probability-weighted) method. August 21, 2019 5% A) Determine the transaction price of this contract, assuming Mets uses Expected Value (probability-weighted) method B) Determine the transaction price of this contract assuming Mets uses Most Likely Outcome method

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts