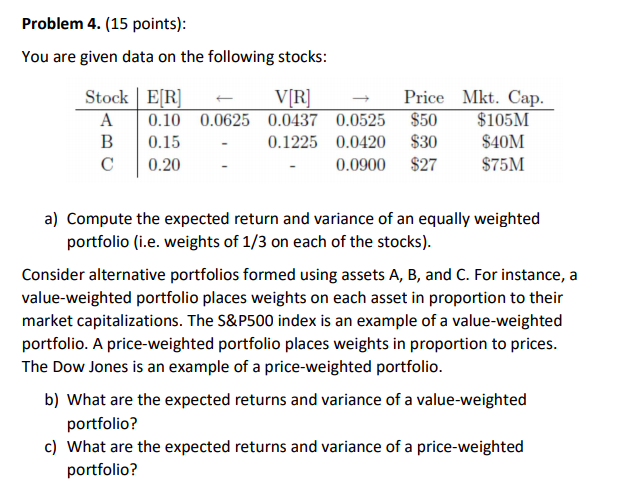

Question: Problem 4. (15 points): You are given data on the following stocks Stock | E[R] VRI Price Mkt. Cap A 0.10 0.0625 0.0437 0.0525 $50

Problem 4. (15 points): You are given data on the following stocks Stock | E[R] VRI Price Mkt. Cap A 0.10 0.0625 0.0437 0.0525 $50 $105M B 0.150.1225 0.0420 $30 $40M C 0.20 - 0.0900 S27 $75M a) Compute the expected return and variance of an equally weighted portfolio (i.e. weights of 1/3 on each of the stocks). Consider alternative portfolios formed using assets A, B, and C. For instance, a value-weighted portfolio places weights on each asset in proportion to their market capitalizations. The S&P500 index is an example of a value-weighted portfolio. A price-weighted portfolio places weights in proportion to prices. The Dow Jones is an example of a price-weighted portfolio. b) What are the expected returns and variance of a value-weighted portfolio? c) What are the expected returns and variance of a price-weighted portfolio

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts