Question: Problem 4 (16 marks) This is a classic retirement problem. A time line will help in solving it. You are turning 35 today and have

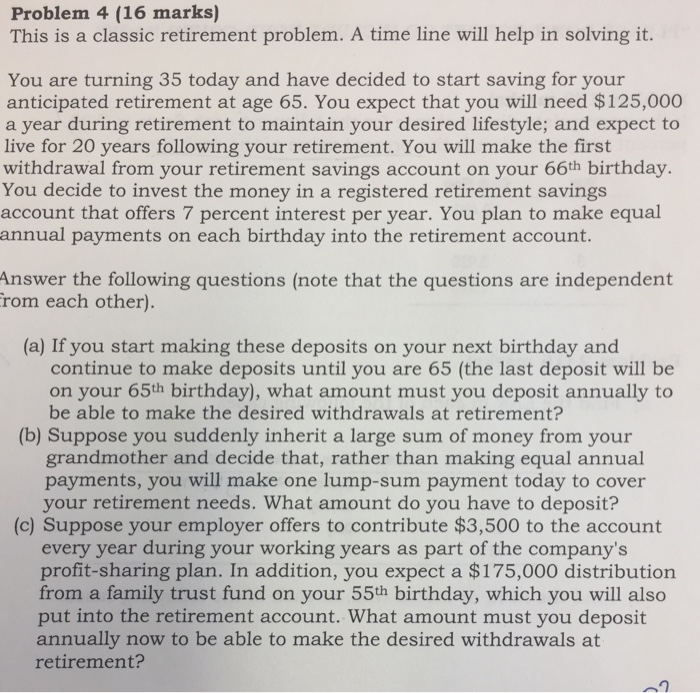

Problem 4 (16 marks) This is a classic retirement problem. A time line will help in solving it. You are turning 35 today and have decided to start saving for your anticipated retirement at age 65. You expect that you will need $125,000 a year during retirement to maintain your desired lifestyle; and expect t live for 20 years following your retirement. You will make the first withdrawal from your retirement savings account on your 66th birthday You decide to invest the money in a registered retirement savings account that offers 7 percent interest per year. You plan to make equal annual payments on each birthday into the retirement account Answer the following questions (note that the questions are independent rom each other) (a) If you start making these deposits on your next birthday and continue to make deposits until you are 65 (the last deposit will be on your 65th birthday), what amount must you deposit annually to be able to make the desired withdrawals at retirement? (b) Suppose you suddenly inherit a large sum of money from your grandmother and decide that, rather than making equal annual payments, you will make one lump-sum payment today to cover your retirement needs. What amount do you have to deposit? (c) Suppose your employer offers to contribute $3,500 to the account every year during your working years as part of the company's profit-sharing plan. In addition, you expect a $175,000 distribution from a family trust fund on your 55th birthday, which you will also put into the retirement account. What amount must you deposit annually now to be able to make the desired withdrawals at retirement

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts