Question: Problem 4. 1772 pts). A. Use the information in Exhibit 4.4 (see page 96) to determine the amount of federal tax payable for each of

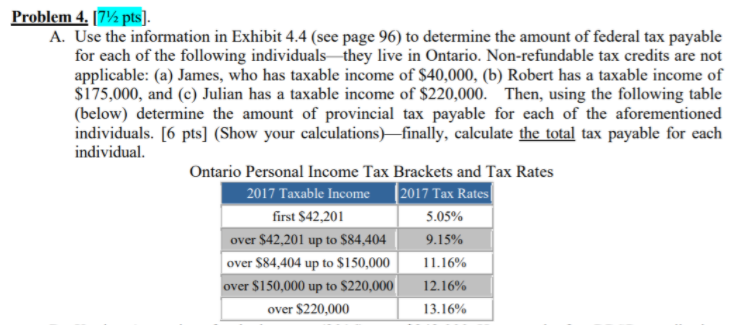

Problem 4. 1772 pts). A. Use the information in Exhibit 4.4 (see page 96) to determine the amount of federal tax payable for each of the following individuals they live in Ontario. Non-refundable tax credits are not applicable: (a) James, who has taxable income of $40,000, (b) Robert has a taxable income of $175,000, and (c) Julian has a taxable income of $220,000. Then, using the following table (below) determine the amount of provincial tax payable for each of the aforementioned individuals. [6 pts] (Show your calculations)finally, calculate the total tax payable for each individual. Ontario Personal Income Tax Brackets and Tax Rates 2017 Taxable Income (2017 Tax Rates first $42,201 5.05% over $42,201 up to $84,404 9.15% over $84,404 up to $150,000 11.16% over $150,000 up to $220,000 12.16% over $220,000 13.16%

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts