Question: Problem 4 - 2 8 ( LO . 1 , 7 ) Luciana, Jon, and Clyde incorporate their respective businesses and form Starling Corporation. On

Problem LO

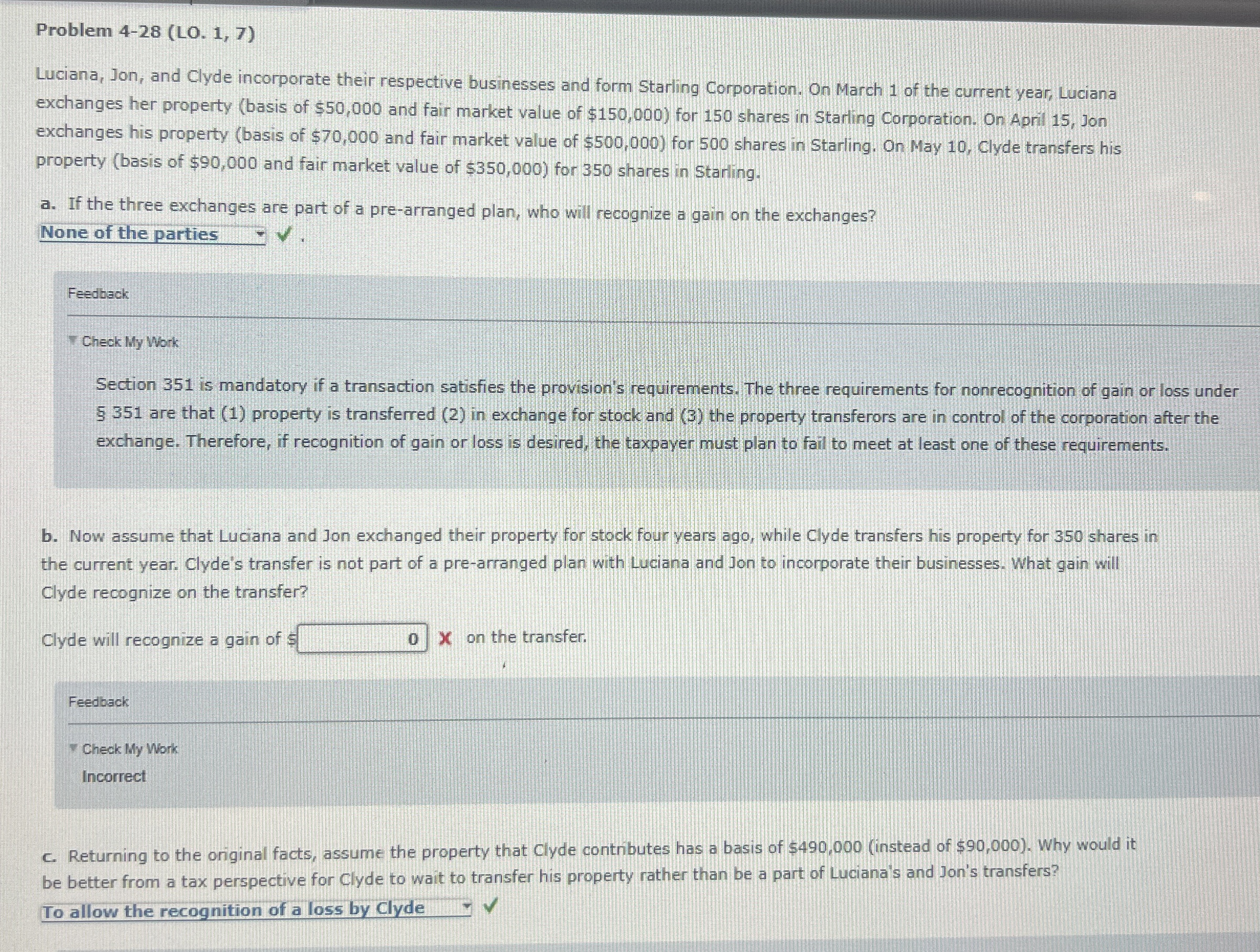

Luciana, Jon, and Clyde incorporate their respective businesses and form Starling Corporation. On March of the current year, Luciana exchanges her property basis of $ and fair market value of $ for shares in Starling Corporation. On April Jon exchanges his property basis of $ and fair market value of $ for shares in Starling. On May Clyde transfers his property basis of $ and fair market value of $ for shares in Starling.

a If the three exchanges are part of a prearranged plan, who will recognize a gain on the exchanges?

None of the parties

Feedback

Check My Work

Section is mandatory if a transaction satisfies the provision's requirements. The three requirements for nonrecognition of gain or loss under are that property is transferred in exchange for stock and the property transferors are in control of the corporation after the exchange. Therefore, if recognition of gain or loss is desired, the taxpayer must plan to fail to meet at least one of these requirements.

b Now assume that Luciana and Jon exchanged their property for stock four years ago, while Clyde transfers his property for shares in the current year. Clyde's transfer is not part of a prearranged plan with Luciana and Jon to incorporate their businesses. What gain will Clyde recognize on the transfer?

Clyde will recognize a gain of $

X on the transfer.

Feedback

Check My Work

Incorrect

C Returning to the original facts, assume the property that Clyde contributes has a basis of $instead of $ Why would it be better from a tax perspective for Clyde to wait to transfer his property rather than be a part of Luciana's and Jon's transfers?

To allow the recognition of a loss by Clyde

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock