Question: Problem 4 - 2 9 ( LO . 1 ) Troy Kennedy exchanges property with a basis of $ 2 0 0 , 0 0

Problem LO

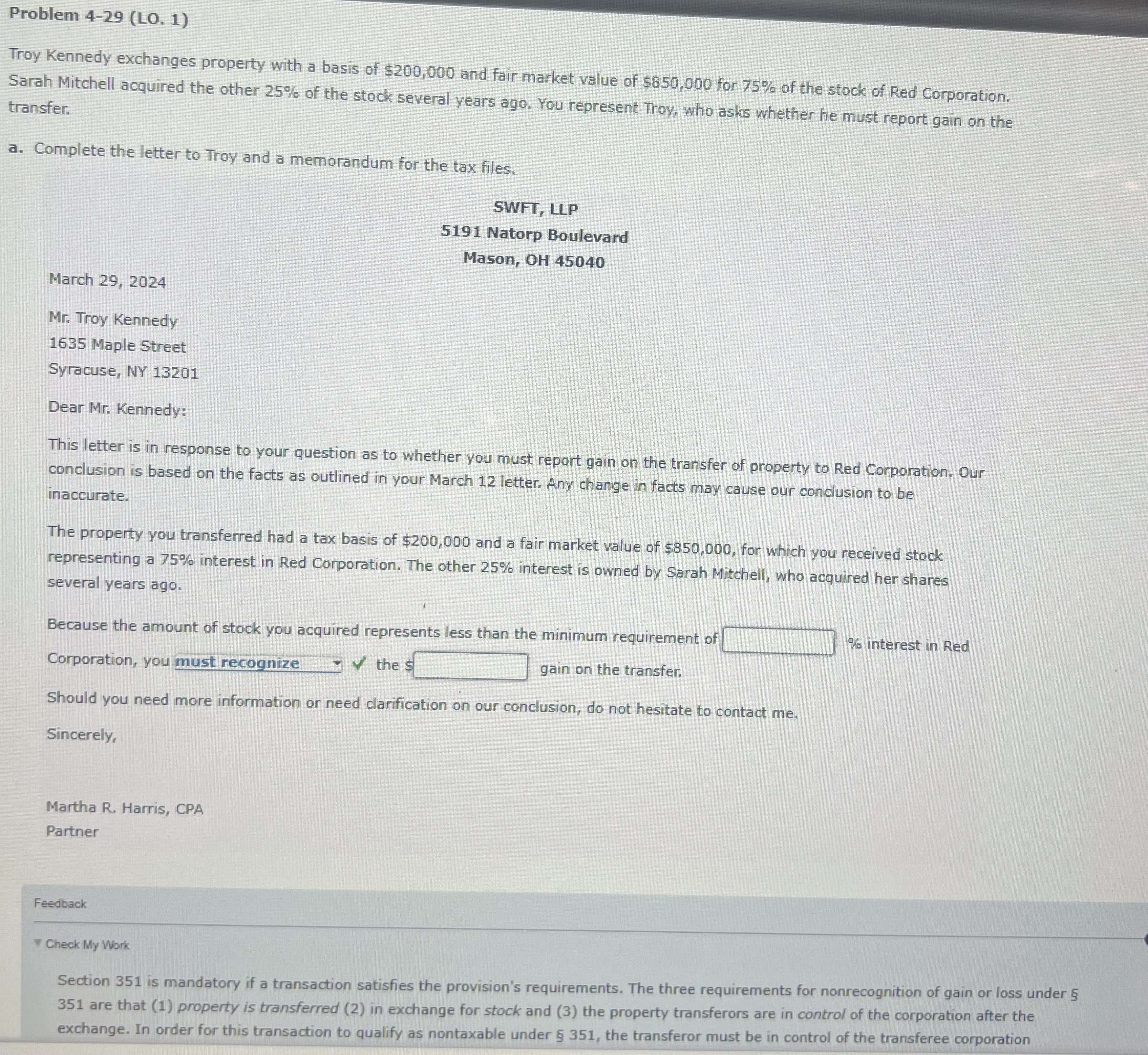

Troy Kennedy exchanges property with a basis of $ and fair market value of $ for of the stock of Red Corporation.

Sarah Mitchell acquired the other of the stock several years ago. You represent Troy, who asks whether he must report gain on the transfer.

a Complete the letter to Troy and a memorandum for the tax files.

SWFT LLP

Natorp Boulevard

Mason, OH

March

Mr Troy Kennedy

Maple Street

Syracuse, NY

Dear Mr Kennedy:

This letter is in response to your question as to whether you must report gain on the transfer of property to Red Corporation. Our conclusion is based on the facts as outlined in your March letter. Any change in facts may cause our conclusion to be inaccurate.

The property you transferred had a tax basis of $ and a fair market value of $ for which you received stock representing a interest in Red Corporation. The other interest is owned by Sarah Mitchell, who acquired her shares several years ago.

Because the amount of stock you acquired represents less than the minimum requirement of interest in Red Corporation, you must recognize the : gain on the transfer.

Should you need more information or need clarification on our conclusion, do not hesitate to contact me

Sincerely,

Martha R Harris, CPA

Partner

Feedback

Check My Work

Section is mandatory if a transaction satisfies the provision's requirements. The three requirements for nonrecognition of gain or loss under are that property is transferred in exchange for stock and the property transferors are in control of the corporation after the exchange. In order for this transaction to qualify as nontaxable under the transferor must be in control of the transferee corporation

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock