Question: Problem 4 (20%) Equity Transactions and Statement Preparation Chan Inc. has two classes of share capital outstanding: 8%, $20 par Cumulative preference shares and $5

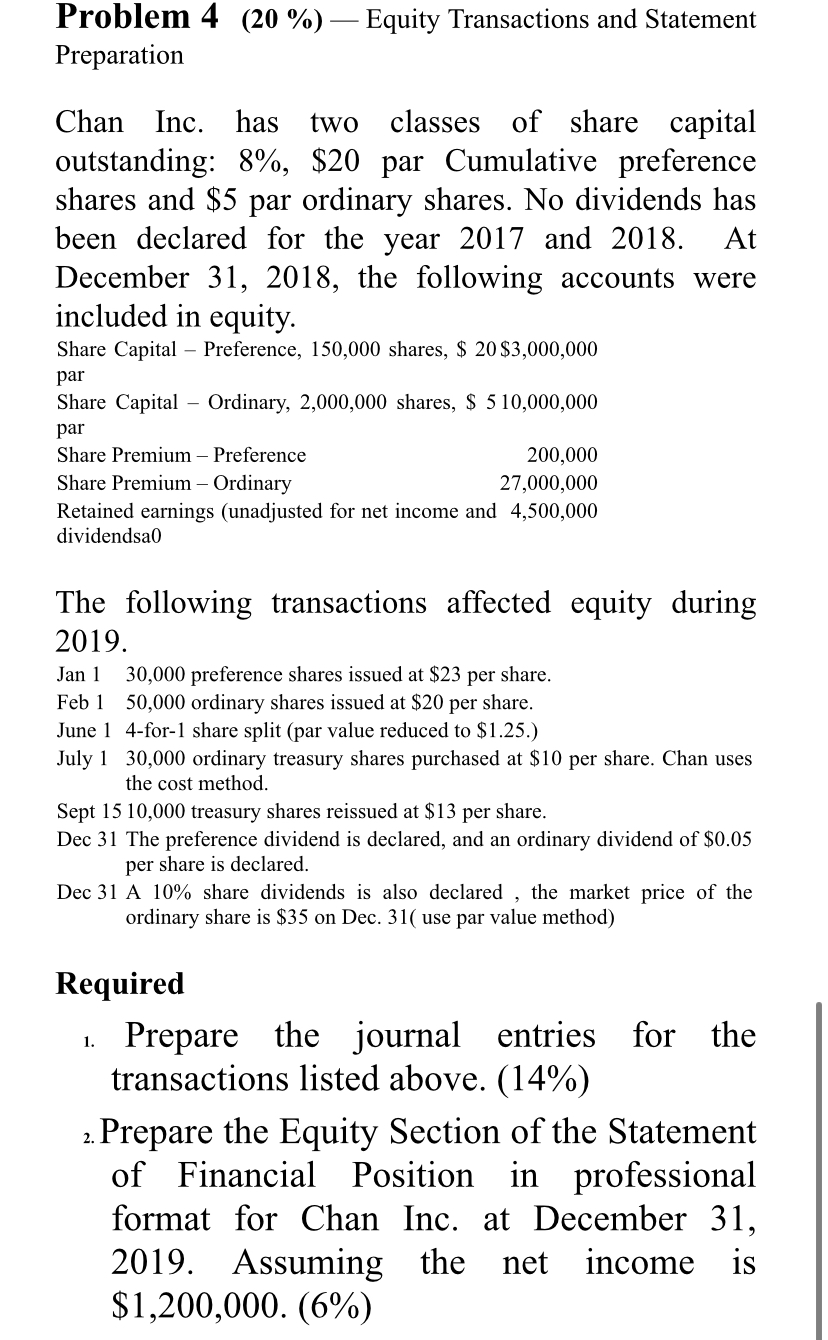

Problem 4 (20%) Equity Transactions and Statement Preparation Chan Inc. has two classes of share capital outstanding: 8%, $20 par Cumulative preference shares and $5 par ordinary shares. No dividends has been declared for the year 2017 and 2018. At December 31, 2018, the following accounts were included in equity. Share Capital - Preference, 150,000 shares, $ 20 $3,000,000 par Share Capital - Ordinary, 2,000,000 shares, $ 510,000,000 par Share Premium Preference 200,000 Share Premium - Ordinary 27,000,000 Retained earnings (unadjusted for net income and 4,500,000 dividendsal The following transactions affected equity during 2019. Jan 1 30,000 preference shares issued at $23 per share. Feb 1 50,000 ordinary shares issued at $20 per share. June 1 4-for-1 share split (par value reduced $1.25.) July 1 30,000 ordinary treasury shares purchased at $10 per share. Chan uses the cost method. Sept 15 10,000 treasury shares reissued at $13 per share. Dec 31 The preference dividend is declared, and an ordinary dividend of $0.05 per share is declared. Dec 31 A 10% share dividends is also declared , the market price of the ordinary share is $35 on Dec. 31( use par value method) 1. 2. Required Prepare the journal entries for the transactions listed above. (14%) Prepare the Equity Section of the Statement of Financial Position in professional format for Chan Inc. at December 31, 2019. Assuming the net income is $1,200,000. (6%)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts