Question: Problem 4 (20 marks) Three call options on a stock have the same expiration date and strike prices of $55, $60, and $65. The market

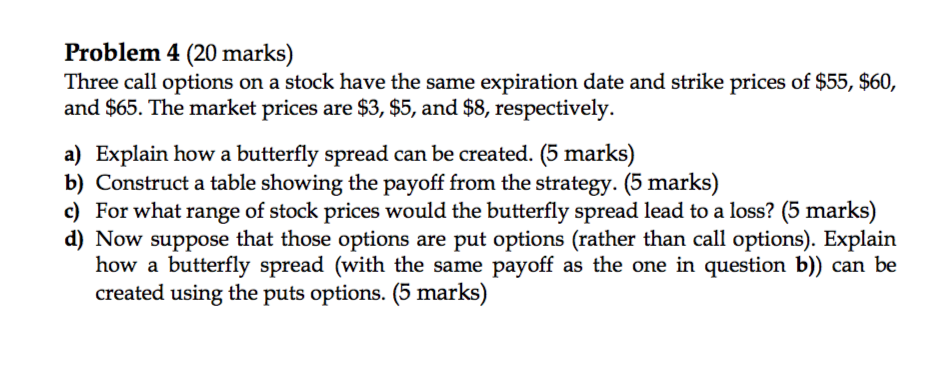

Problem 4 (20 marks) Three call options on a stock have the same expiration date and strike prices of $55, $60, and $65. The market prices are $3, $5, and $8, respectively. a) Explain how a butterfly spread can be created. (5 marks) b) Construct a table showing the payoff from the strategy. (5 marks) c) For what range of stock prices would the butterfly spread lead to a loss? (5 marks) d) Now suppose that those options are put options (rather than call options). Explain how a butterfly spread (with the same payoff as the one in question b) can be created using the puts options

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts