Question: Problem 4 [20 Points] At time 0, a firm has positive NPV project, whose cash flow will be realized at time 2. For the project

![Problem 4 [20 Points] At time 0, a firm has positive](https://dsd5zvtm8ll6.cloudfront.net/si.experts.images/questions/2024/09/66ed9e00cefb5_51266ed9e0073750.jpg)

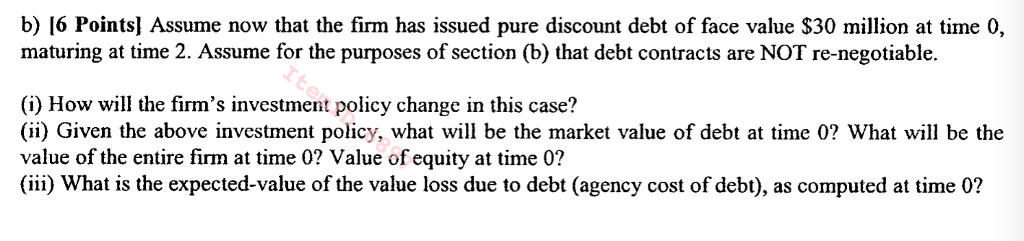

Problem 4 [20 Points] At time 0, a firm has positive NPV project, whose cash flow will be realized at time 2. For the project to be implemented, firm management has to invest an amount I-$80 million in the (non-divisible) project at an intermediate date t-1, after observing an underlying economic variable (the "state") which will be realized between time 0 and 1, and which affects the profitability of the project. The probability distribution of the various states at time 0 and the gross project cash flows in each state are as follows: State: Probabilit;y Cash Flow in millions SI 0.25 150 S2 0.25 120 S3 0.25 100 S4 0.25 20 If firm management (who acts in the interest of equity holders) chooses to go ahead and invests in the project, they will raise the amount I by selling new equity; if they do not invest in the project, the project is not implemented, and zero cash flows are realized. The state is observable by both managers/insiders who make the investment decisions as well as outsiders. Assume that the firm has no assets in place, and the new project is the only source of value to the firm (if any). All agents are risk-neutral, and the risk free rate of return is zero a) [4 Points] First assume that there is no debt issued at time 0. Give the investment policy chosen by management as a function of the state. What will the firm's equity value be at time 0 in this case? Problem 4 [20 Points] At time 0, a firm has positive NPV project, whose cash flow will be realized at time 2. For the project to be implemented, firm management has to invest an amount I-$80 million in the (non-divisible) project at an intermediate date t-1, after observing an underlying economic variable (the "state") which will be realized between time 0 and 1, and which affects the profitability of the project. The probability distribution of the various states at time 0 and the gross project cash flows in each state are as follows: State: Probabilit;y Cash Flow in millions SI 0.25 150 S2 0.25 120 S3 0.25 100 S4 0.25 20 If firm management (who acts in the interest of equity holders) chooses to go ahead and invests in the project, they will raise the amount I by selling new equity; if they do not invest in the project, the project is not implemented, and zero cash flows are realized. The state is observable by both managers/insiders who make the investment decisions as well as outsiders. Assume that the firm has no assets in place, and the new project is the only source of value to the firm (if any). All agents are risk-neutral, and the risk free rate of return is zero a) [4 Points] First assume that there is no debt issued at time 0. Give the investment policy chosen by management as a function of the state. What will the firm's equity value be at time 0 in this case

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts