Question: Problem # 4: (20 points): At time t 0, in the bond market you observe a regular coupon bond with the following characteristics: Face value:

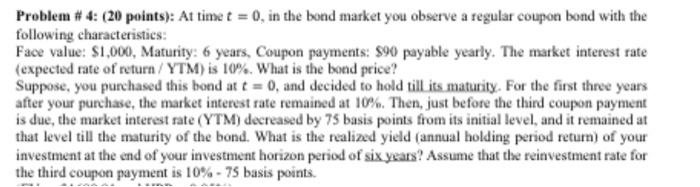

Problem # 4: (20 points): At time t 0, in the bond market you observe a regular coupon bond with the following characteristics: Face value: $1,000, Maturity: 6 years, Coupon payments: $90 payable yearly. The market interest rate (expected rate of return / YTM) is 10%. What is the bond price? Suppose, you purchased this bond at t 0, and decided to hold till its maturity. For the first three years after your purchase, the market interest rate remained at 10% Then, just before the third coupon payment is due, the market interest rate (YTM) decreased by 75 basis points from its initial level, and it remained at that level till the maturity of the bond. What is the realized yield (annual holding period return) of your investment at the end of your investment horizon period of the third coupon payments 10%: 75 basis points. ?Assume that the reinvestment rate for

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts