Question: PROBLEM 4 (20 points) Currently, you are considering the use of Option contracts as derivative product to increase the characteristics of the risk and return

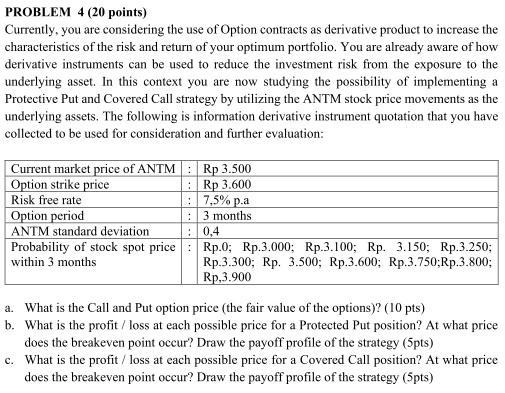

PROBLEM 4 (20 points) Currently, you are considering the use of Option contracts as derivative product to increase the characteristics of the risk and return of your optimum portfolio. You are already aware of how derivative instruments can be used to reduce the investment risk from the exposure to the underlying asset. In this context you are now studying the possibility of implementing a Protective Put and Covered Call strategy by utilizing the ANTM stock price movements as the underlying assets. The following is information derivative instrument quotation that you have collected to be used for consideration and further evaluation: Current market price of ANTM : Rp 3.500 Option strike price : Rp 3.600 Risk free rate : 7,5% pa Option period 3 months ANTM standard deviat : 0,4 Probability of stock spot price : Rp.0; Rp.3.000: Rp.3.100; Rp. 3.150; Rp.3.250; within 3 months Rp.3.300; Rp. 3.500; Rp.3.600; Rp.3.750;Rp.3.800; Rp.3.900 a. What is the Call and Put option price (the fair value of the options)? (10 pts) b. What is the profit / loss at each possible price for a Protected Put position? At what price does the breakeven point occur? Draw the payoff profile of the strategy (5pts) c. What is the profit / loss at each possible price for a Covered Call position? At what price does the breakeven point occur? Draw the payoff profile of the strategy (5pts) PROBLEM 4 (20 points) Currently, you are considering the use of Option contracts as derivative product to increase the characteristics of the risk and return of your optimum portfolio. You are already aware of how derivative instruments can be used to reduce the investment risk from the exposure to the underlying asset. In this context you are now studying the possibility of implementing a Protective Put and Covered Call strategy by utilizing the ANTM stock price movements as the underlying assets. The following is information derivative instrument quotation that you have collected to be used for consideration and further evaluation: Current market price of ANTM : Rp 3.500 Option strike price : Rp 3.600 Risk free rate : 7,5% pa Option period 3 months ANTM standard deviat : 0,4 Probability of stock spot price : Rp.0; Rp.3.000: Rp.3.100; Rp. 3.150; Rp.3.250; within 3 months Rp.3.300; Rp. 3.500; Rp.3.600; Rp.3.750;Rp.3.800; Rp.3.900 a. What is the Call and Put option price (the fair value of the options)? (10 pts) b. What is the profit / loss at each possible price for a Protected Put position? At what price does the breakeven point occur? Draw the payoff profile of the strategy (5pts) c. What is the profit / loss at each possible price for a Covered Call position? At what price does the breakeven point occur? Draw the payoff profile of the strategy (5pts)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts