Question: PROBLEM 4 (24 Marks) Problem 4-Part A [8 marks]: On January 1, 2020, the HHI Company purchased 10% coupon-rate bonds with a face value of

![PROBLEM 4 (24 Marks) Problem 4-Part A [8 marks]: On January](https://dsd5zvtm8ll6.cloudfront.net/si.experts.images/questions/2024/09/66f1f9401e5c2_01566f1f93fb2aad.jpg)

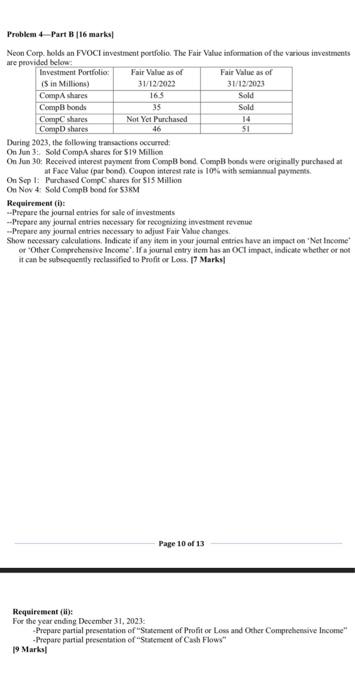

PROBLEM 4 (24 Marks) Problem 4-Part A [8 marks]: On January 1, 2020, the HHI Company purchased 10% coupon-rate bonds with a face value of $250,000. The maturity date is December 31,2030 . The interests are paid semiannually on June 30 and December 31. The market interest rate (yield) was 12%. The bonds were classified as held-to- maturity. Required: Prepare joumal entries to record: (1) the purchase of the bonds on January 1, 2020; (2) the necessary adjustments on June 30, 2021 (3) the necessary adjustments on December 31,2021 Show the necessary calculations. For each step in the calculation, round to 2 decimal places (basically round to nearest cent). Hint: Constructing a bond premium/amortization schedule will be useful. Use the PV tables provided with your Answer Booklet. Using the calculator may cause you to get slightly different answers. Problem 4-Part B (16 marks) Neon Coop. bolds an FVOCI investment portfolio. The Fair Value infontration of the various investments are peovidiat holow- During 2023, the following tranuctions occurred. On Jun 3: Sold Comp. shares for 519 Millice On Jun 30, Received interest paymest from CompB bond. CompB boeds were originally purchased at at Face Value (par bond). Coupon intertul rate is 10 is witb wemiannal payments. On Sep 1: Purchased Conpe shares for 515 Million On Nev 4: Sold CeempB hond for 53kM Requirement (i): -Prepare the journal entries for sale of investments - Propore any journal entries necessary fie recognizing invesencet tevenue -. Prepare any journal entries necessary to adjust Fair Value changes. Show necessary calculations. Indicate if any inem in your joumal contries have an impact on 'Net Inceme' of 'Other Comprebensive Inceme'. If a journal evitry item has an OCl ingact, indicale whether of not it can be subsequently reclassified to Profit or Loss. [7 Marks] Page 10 of 13 Requirement (ii): For the year ending December 31, 2023: "Prepare partial pecseatation of "Seatenaent of Profit or Loos and Orther Comprehenaive Income" -Prepare pantial pecentation of "Seaterient of Cash Flows" [9 Marks]

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts