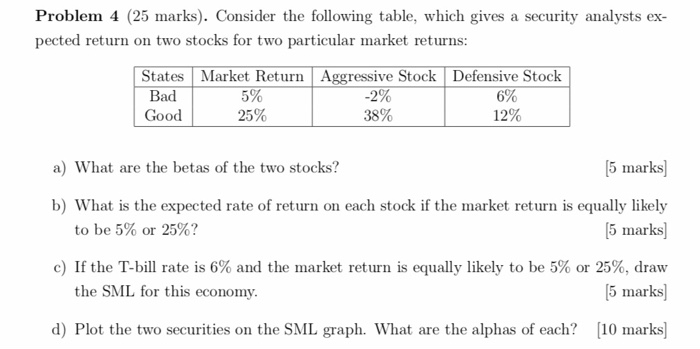

Question: Problem 4 (25 marks). Consider the following table, which gives a security analysts ex- pected return on two stocks for two particular market returns: States

Problem 4 (25 marks). Consider the following table, which gives a security analysts ex- pected return on two stocks for two particular market returns: States Market Return Aggressive Stock Defensive Stock 5% -2% 6% Good 25% 38% 12% Bad a) What are the betas of the two stocks? (5 marks) b) What is the expected rate of return on each stock if the market return is equally likely to be 5% or 25%? [5 marks) c) If the T-bill rate is 6% and the market return is equally likely to be 5% or 25%, draw the SML for this economy. [5 marks d) Plot the two securities on the SML graph. What are the alphas of each? [10 marks Problem 4: b) Weighted average return formula; c) Graph; d) Index Model of CAPM + Graph

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts