Question: Problem 4 (25 points) Suppose that stock B is currently selling at $100. A call option on stock B expiring after 2 years is selling

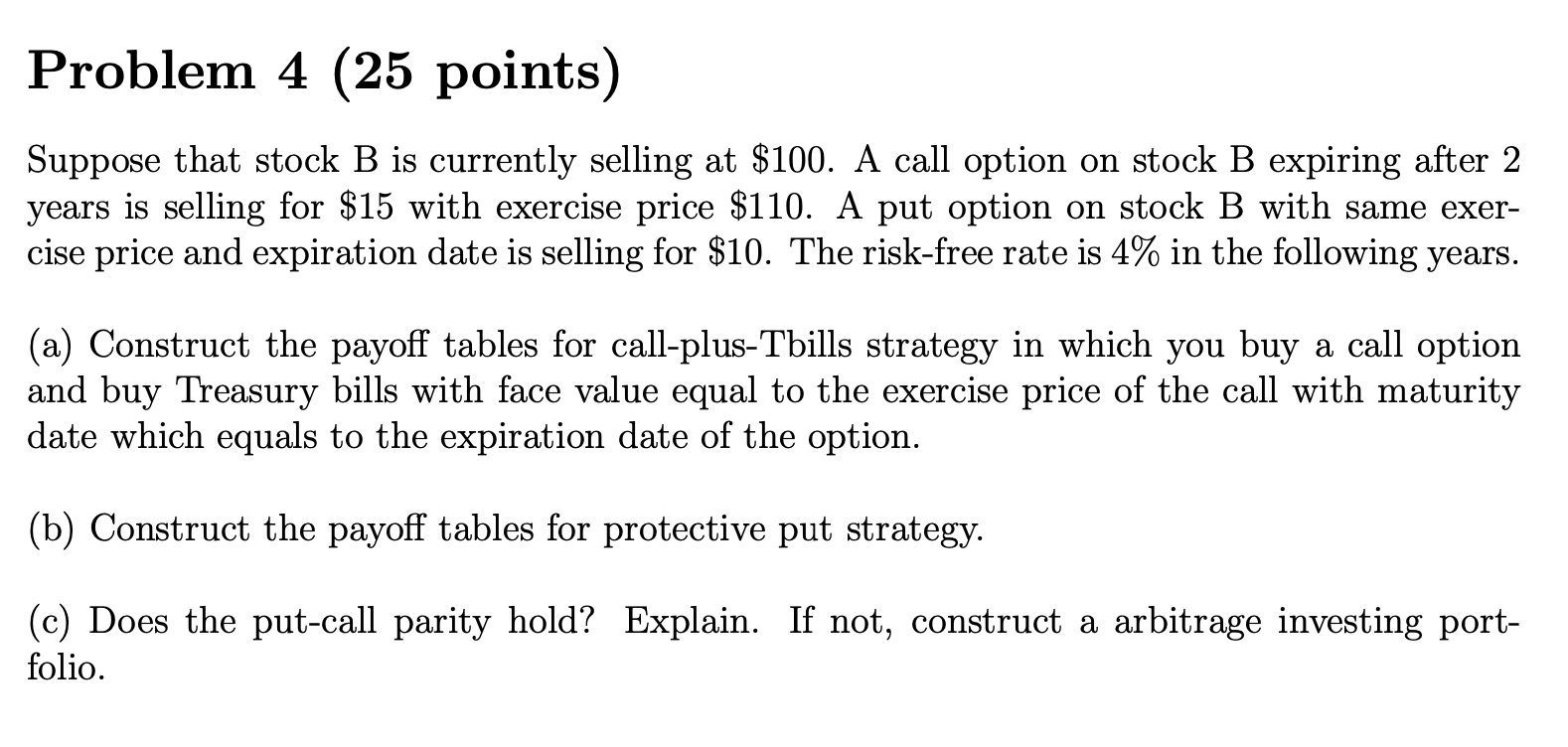

Problem 4 (25 points) Suppose that stock B is currently selling at $100. A call option on stock B expiring after 2 years is selling for $15 with exercise price $110. A put option on stock B with same exer- cise price and expiration date is selling for $10. The risk-free rate is 4% in the following years. (a) Construct the payoff tables for call-plus-Tbills strategy in which you buy a call option and buy Treasury bills with face value equal to the exercise price of the call with maturity date which equals to the expiration date of the option. (b) Construct the payoff tables for protective put strategy. (c) Does the put-call parity hold? Explain. If not, construct a arbitrage investing port- folio. Problem 4 (25 points) Suppose that stock B is currently selling at $100. A call option on stock B expiring after 2 years is selling for $15 with exercise price $110. A put option on stock B with same exer- cise price and expiration date is selling for $10. The risk-free rate is 4% in the following years. (a) Construct the payoff tables for call-plus-Tbills strategy in which you buy a call option and buy Treasury bills with face value equal to the exercise price of the call with maturity date which equals to the expiration date of the option. (b) Construct the payoff tables for protective put strategy. (c) Does the put-call parity hold? Explain. If not, construct a arbitrage investing port- folio

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts