Question: Problem 4 - 3 0 ( LO . 6 ) Julieta Simms is the president and sole shareholder of Simms Corporation. Julieta plans for the

Problem LO

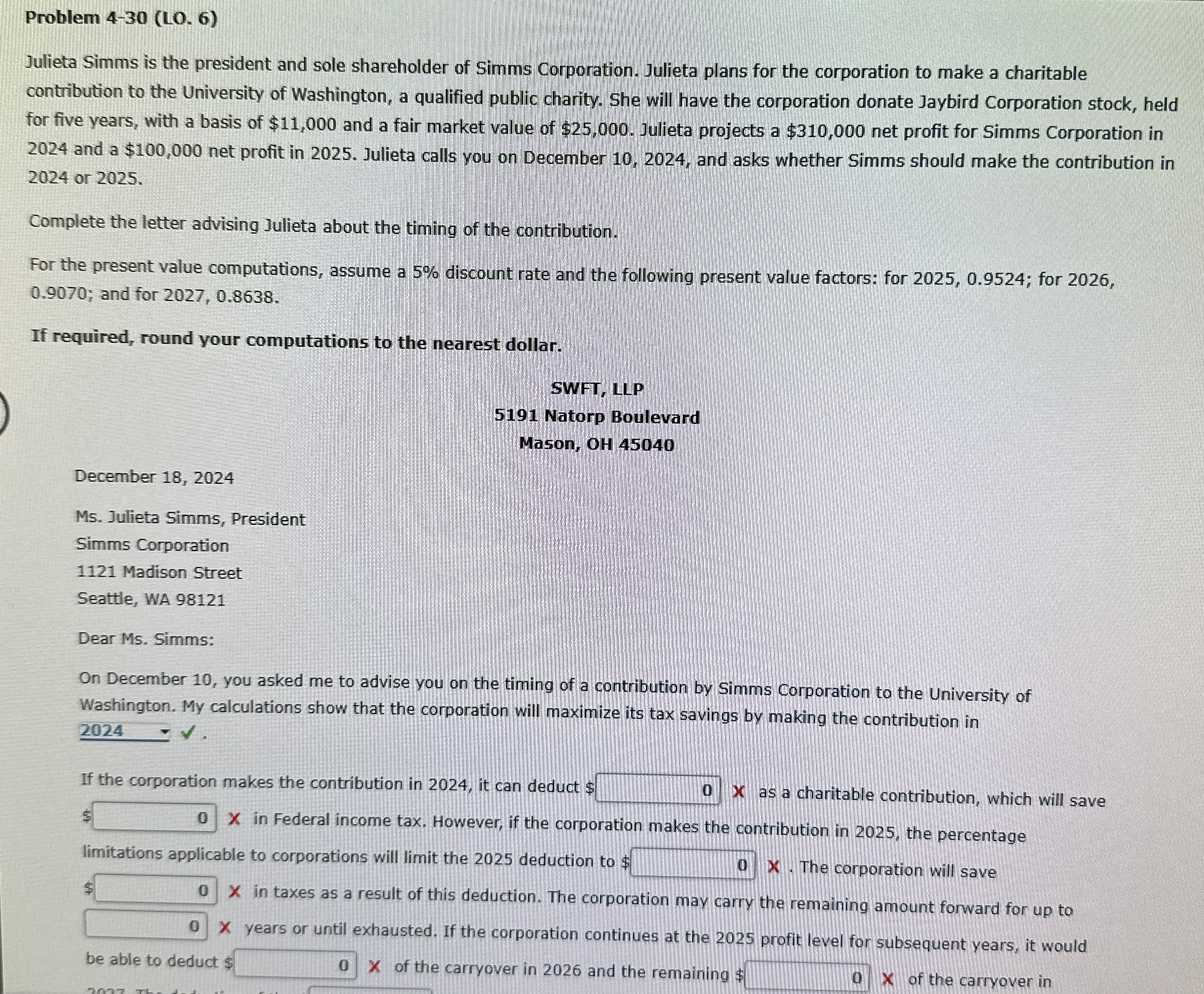

Julieta Simms is the president and sole shareholder of Simms Corporation. Julieta plans for the corporation to make a charitable contribution to the University of Washington, a qualified public charity. She will have the corporation donate Jaybird Corporation stock, held for five years, with a basis of $ and a fair market value of $ Julieta projects a $ net profit for Simms Corporation in and a $ net profit in Julieta calls you on December and asks whether Simms should make the contribution in or

Complete the letter advising Julieta about the timing of the contribution.

For the present value computations, assume a discount rate and the following present value factors: for ; for ; and for

If required, round your computations to the nearest dollar.

SWFT LLP

Natorp Boulevard Mason, OH

December

Ms Julieta Simms, President

Simms Corporation

Madison Street

Seattle, WA

Dear Ms Simms:

On December you asked me to advise you on the timing of a contribution by Simms Corporation to the University of Washington. My calculations show that the corporation will maximize its tax savings by making the contribution in

If the corporation makes the contribution in it can deduct $ x as a charitable contribution, which will save $ in Federal income tax. However, if the corporation makes the contribution in the percentage limitations applicable to corporations will limit the deduction to $ X The corporation will save $

be able to deduct $ of the carryover in and the remaining $ X of the carryover in

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock