Question: Problem 4 - 3 6 ( Algo ) ( LO 4 - 1 , 4 - 4 , 4 - 8 ) Following are the

Problem AlgoLO

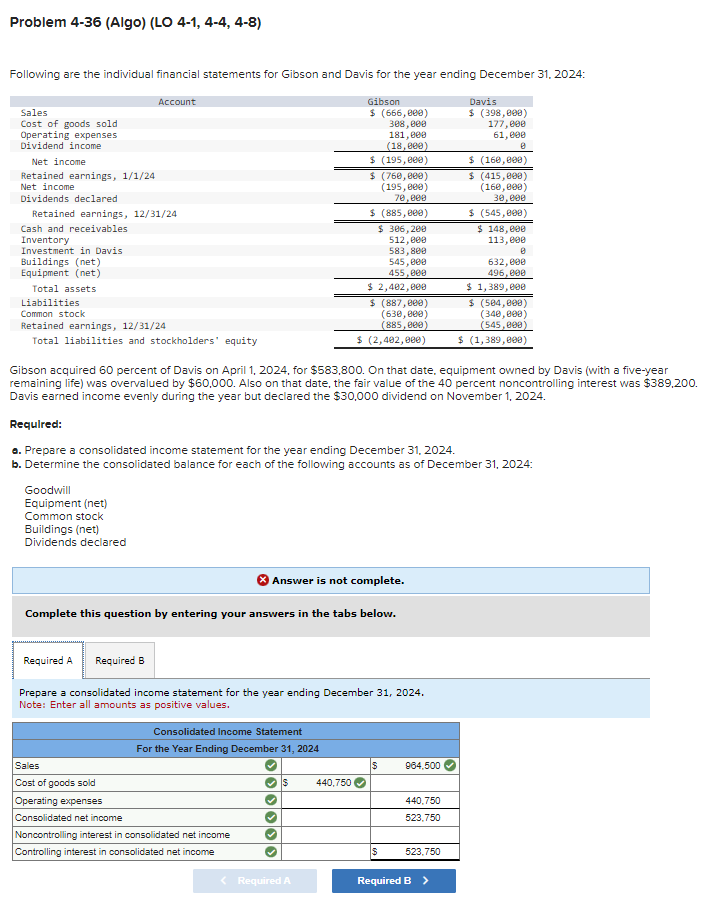

Following are the individual financial statements for Gibson and Davis for the year ending December :

Gibson acquired percent of Davis on April for $ On that date, equipment owned by Davis with a fiveyear

remaining life was overvalued by $ Also on that date, the fair value of the percent noncontrolling interest was $

Davis earned income evenly during the year but declared the $ dividend on November

Requlred:

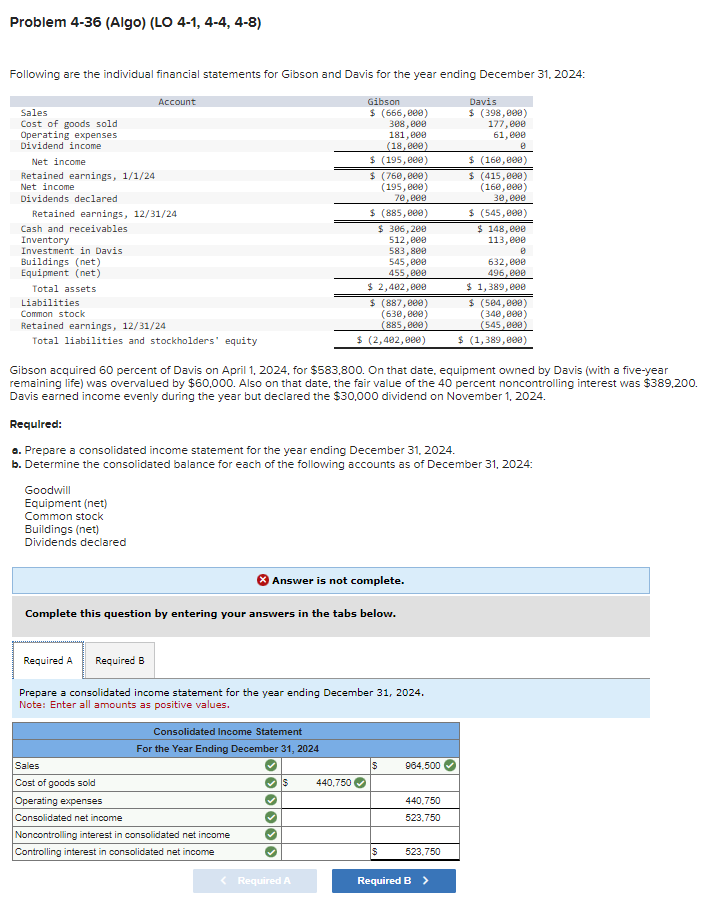

Q Prepare a consolidated income statement for the year ending December

b Determine the consolidated balance for each of the following accounts as of December :

Goodwill

Equipment net

Common stock

Buildings net

Dividends declared

Answer is not complete.

Complete this question by entering your answers in the tabs below.

Prepare a consolidated income statement for the year ending December

Note: Enter all amounts as positive values.Problem AlgoLO

Following are the individual financial statements for Gibson and Davis for the year ending December :

Account Gibson Davis

Sales $ $

Cost of goods sold

Operating expenses

Dividend income

Net income $ $

Retained earnings, $ $

Net income

Dividends declared

Retained earnings, $ $

Cash and receivables $ $

Inventory

Investment in Davis

Buildings net

Equipment net

Total assets $ $

Liabilities $ $

Common stock

Retained earnings,

Total liabilities and stockholders' equity $ $

Gibson acquired percent of Davis on April for $ On that date, equipment owned by Davis with a fiveyear remaining life was overvalued by $ Also on that date, the fair value of the percent noncontrolling interest was $ Davis earned income evenly during the year but declared the $ dividend on November

Required:

Prepare a consolidated income statement for the year ending December

Determine the consolidated balance for each of the following accounts as of December :

Goodwill

Equipment net

Common stock

Buildings net

Dividends declared

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock