Question: Problem 4 - 3 7 ( Algo ) ( LO 4 - 2 , 4 - 3 , 4 - 6 , 4 - 7

Problem AlgoLO

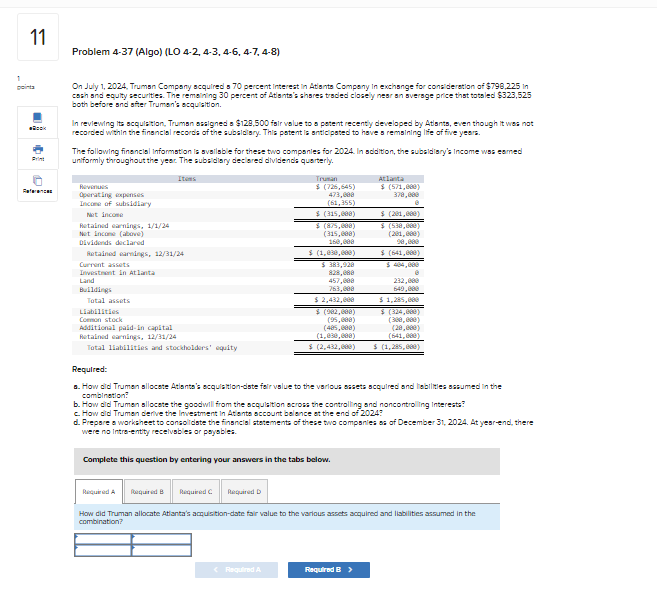

On July Trumsn Company scquired s percent interest in Atisnts Company In exchsnge for consideratian af $ in

cash sid equity securities The remaining percent of Ationts's shares traded clasely near an sversge price thst tataled $

both before snd siter Truman's acqu'sition.

In reviewing its scqulation, Trumsn sasigned a $ fair value to a patent recenty developed by Atisnts, even though it was nat

recorded whin the financial records of the subsidisry. This patent is anticipoted to have remsining life of five years.

The following financisilinformstion is svalisble for these two componies for In sodition, the subsidiary's Income wss eamed

unlformly throughout the year The subsidary deciored dividends quarterly.

Required:

B How ald Truman sllocete Ationts's acquistiondste folr vslue to the various assets scquired and labilites sasumed in the

combination?

b How ald Truman sllocete the goodwill from the acquaition across the contralling and noncontro ing interesta?

c How did Truman derive the Investment in Ationta account balonce at the end of

d Prepsre a warksheet to consoldste the finsncisl statements of these two compsnies as of December At yesrend, there

were no Intreentity recelvibles ar poyobles.

Complete this question by entering your answers in the tabs below.

How did Truman allocate Atlinta's acmusitiondate fair value to the various assets acquired and lisbilities assumed in the

combination?

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock