Question: Problem 4 - 3 7 ( LO . 1 , 2 , 3 ) Cynthia, a sole proprietor, was engaged in a service business and

Problem LO

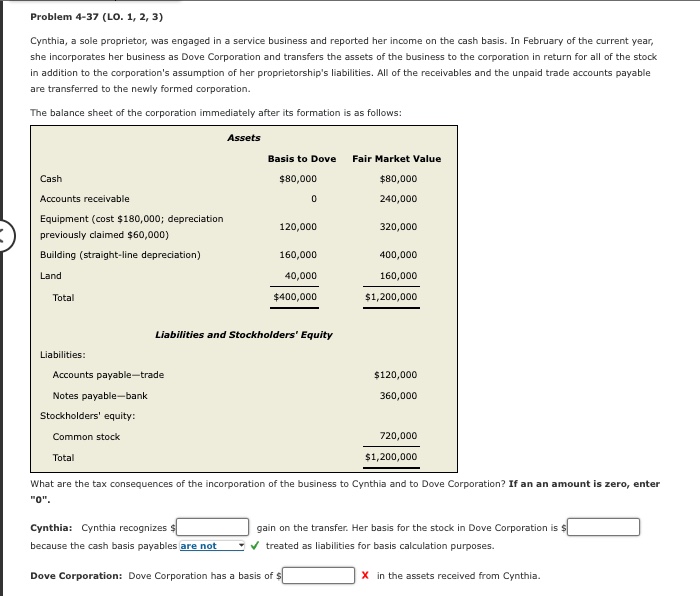

Cynthia, a sole proprietor, was engaged in a service business and reported her income on the cash basis. In February of the current year,

she incorporates her business as Dove Corporation and transfers the assets of the business to the corporation in return for all of the stock

in addition to the corporation's assumption of her proprietorship's liabilities. All of the receivables and the unpaid trade accounts payable

are transferred to the newly formed corporation.

The balance sheet of the corporation immediately after its formation is as follows:

Assets

Liabilities and Stockholders' Equity

Liabilities:

Accounts payabletrade

Stockholders' equity:

Common stock

What are the tax consequences of the incorporation of the business to Cynthia and to Dove Corporation? If an an amount is zero, enter

Cynthia: Cynthia recognizes $

gain on the transfer. Her basis for the stock in Dove Corporation is $

because the cash basis payables are not treated as liabilities for basis calculation purposes.

Dove Corporation: Dove Corporation has a basis of $

in the assets received from Cynthia.

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock